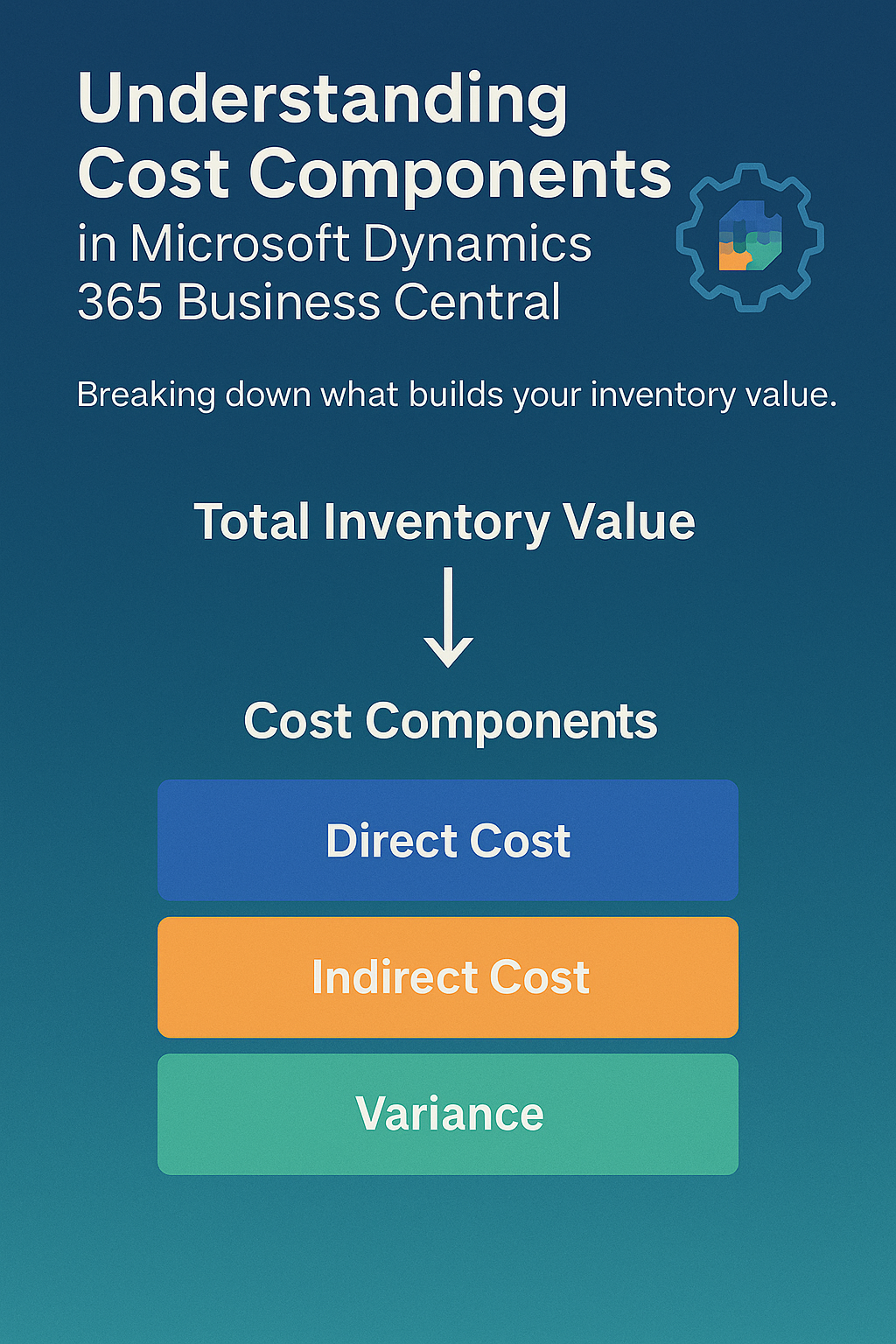

In Microsoft Dynamics 365 Business Central, cost components form the foundation of how the system values inventory movements - whether it’s a purchase, production, or sale. Each cost component represents a specific element contributing to the total value of an item, helping organizations maintain transparency, control, and accuracy in their financial and inventory reporting.

Understanding Cost Components

At its core, a cost component is the type of cost that builds up the total value of an inventory increase or decrease. Business Central categorizes these components into several key types, each representing different cost behaviors and business implications.

The most fundamental category is the Direct Cost, which includes costs that can be directly traced to a specific cost object - for example, the unit purchase cost of an item. Along with the unit cost, direct costs often include freight and insurance charges, which are typically managed as item charges. These additional costs directly impact the item’s landed cost and ensure that every expense associated with acquiring an item is accounted for accurately.

On the other hand, Indirect Costs represent expenses that cannot be directly traced to a single cost object. These might include factory overheads, administrative expenses, or general operating costs that are spread across multiple products or departments.

Another unique category is Direct Cost – Non Inventory, used for costs that are directly related to operations but do not affect physical inventory valuation - such as subcontracting or service-related charges.

When it comes to manufacturing environments using the Standard Costing method, Business Central introduces the concept of Variances. Variances reflect the differences between actual and standard costs, helping businesses analyze where deviations occur. These include Purchase Variance, Material Variance, Capacity Variance, Subcontracted Variance, Capacity Overhead Variance, and Manufacturing Overhead Variance. Each variance type provides valuable insights into performance and cost control, highlighting areas where efficiency can be improved or adjustments are needed.

In addition to these, there are two more cost components that play a vital role in maintaining valuation accuracy: Revaluation and Rounding.- Revaluation accounts for the appreciation or depreciation of current inventory value, allowing companies to reflect updated cost realities over time.

- Rounding handles minor residual differences that occur during the valuation of inventory decreases, ensuring smooth reconciliation and accurate reporting.

Freight and Insurance - The Flexible Additions

Freight and insurance are special because they can be added to an item’s cost at any time as item charges. When the Adjust Cost - Item Entries batch job runs, these charges automatically adjust the value of related inventory decreases, ensuring that the financial and item ledger entries remain synchronized and accurate. This flexibility ensures that businesses can include all relevant landed costs, even after the initial receipt or production posting.

Why This Matters

The design of cost components in Business Central provides businesses with granular cost visibility and robust financial control. By breaking down item costs into meaningful categories, organizations can trace every rupee or dollar of expense, analyze cost deviations, and make more informed decisions in purchasing, pricing, and production.

Moreover, this level of detail supports compliance and audit requirements - ensuring transparency in how costs flow from procurement or production through to the general ledger. Whether dealing with direct costs, indirect expenses, or standard cost variances, understanding cost components helps finance and operations teams maintain accuracy, consistency, and confidence in their financial data.

Final Thoughts

The Cost Component Design in Microsoft Dynamics 365 Business Central isn’t just a technical setup - it’s a strategic tool that empowers businesses to manage inventory valuation more intelligently. By understanding and leveraging each component, companies can gain a complete picture of their cost structure, improve efficiency, and achieve greater financial clarity across all operations.