De-mystifying Currency Revaluation in Microsoft Dynamics GP

Mike Muscarella

Multi-currency accounting can send shivers of fear and confusion through the spines of financial professionals (and some ERP consultants). In particular, the process of month-end currency revaluation can seem especially daunting. However, with the power of Microsoft Dynamics GP and the industry-leading knowledge and expertise of Boyer & Associates, currency revaluation can be a stress-free part of your month-end close process.

Currency revaluation is the process in which Dynamics GP retranslates foreign currency month-end balances at the current month-end exchange rate. The difference between the previously translated month-end balance and the retranslated balance is a currency gain or loss on exchange, often recorded as an “unrealized” gain or loss. Revaluation is typically performed for balance sheet control accounts such as accounts payable and accounts receivable, but GP can be configured to revalue any financial account necessary.

In the example we will work through, we have a Dynamics GP company with functional currency of U.S. Dollars (USD) in which we invoice our overseas customers in Euros. As Euro invoices are generated throughout the month, GP Multicurrency Management translates each invoice to USD based on exchange rates that have been saved to the exchange rate table shown below.

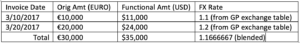

In our example, we generated two Euro invoices on the 10th and 20th of the month that were translated to USD using the rates from the exchange table.

The resulting USD total receivable represents a blended rate of the two transactions. In accordance with GAAP standards, the month-end Euro balance of the receivables account must be revalued at the month-end spot rate. Dynamics GP easily accomplishes this through the Multicurrency Revaluation process.

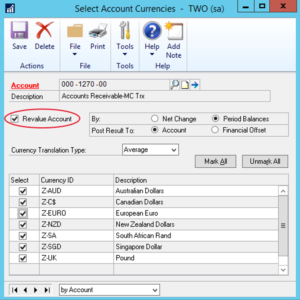

First, there are some required setups. In our example the receivables control account 000-1270-00 must be configured for revaluation by going to Financial > Cards > Account Maintenance, selecting the account and clicking on the “Currency” button. In the Select Account Currencies window, the “Revalue Account” checkbox must be marked and the appropriate currencies selected.

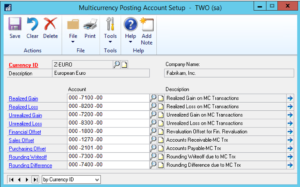

Also, the currency posting accounts must be configured under Financial > Setup > Currency Accounts. For our example, the Unrealized Gain/Loss accounts will be used.

Performing a Currency Revaluation in Microsoft Dynamics GP

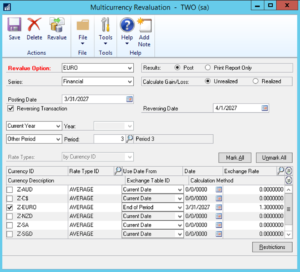

To perform the revaluation, go to Financial > Routines > Revaluation to access the Multicurrency Revaluation window.

- Enter a Revalue Option name. You can create multiple options, each with different saved parameters.

- Select “Print Report Only” to test the revaluation by printing the revaluation report without posting the results. Select “Post” to print the report and post the resulting entry.

- Set the Calculate Gain/Loss option. The default is “Unrealized,” which is the typical setting.

- Enter the Posting Date and Reversal Date if you want the gain/loss to be reversed.

- Select the year and period to be revalued.

- Check the box for each currency to be revalued. You can revalue multiple currencies simultaneously or set up different options for each currency. Select “End of Period” to default the end-of-month rate from the exchange table.

- Use the “Restrictions” button to set ranges of posting accounts or account segments to be revalued.

- Click “Revalue” to process the revaluation. The Revaluation Journal report displays each revalued account with its originating balance, blended rate and functional amount. The Unrealized Gain and Loss columns reflect the calculated revaluation amount.

In our example, the originating balance of €30,000 is revalued at the month-end rate of 1.3, which totals $39,000 USD. The functional balance of the account is currently $35,000 USD, which results in an unrealized gain of $4,000 USD ($39,000 – $35,000 = $4,000). Note that the calculated gain or loss amounts are always recorded in the functional currency.

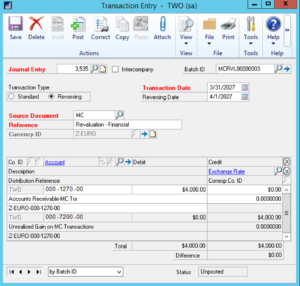

If you selected to post the results, the revaluation process creates a General Ledger journal entry to record the exchange gain or loss. In our example, the $4,000 USD gain is recorded to the Unrealized Gain account 000-7200-00 from the Multicurrency Posting Account Setup. The offset is recorded to the original account 000-1270-00 as shown below.

That’s it! In a future post we’ll look at what happens when the overseas customer submits a Euro payment and how Dynamics GP accounts for the resulting “realized” exchange gain or loss. Until then, contact Boyer & Associates at info@boyerassoc.com for answers to your Dynamics GP multi-currency questions.

The post De-mystifying Currency Revaluation in GP first appeared on https://www.boyerassoc.com.

Like

Like Report

Report

*This post is locked for comments