As a follow-on to last week's article on Shipping Methods and Types, here, explained in excruciating detail, is GP sales tax calculation logic.

When the system calculates tax on a sale or purchase transaction, it compares the tax schedule assigned to the customer or vendor, as well as the tax schedule assigned to the sale or purchase transaction and any freight and miscellaneous charges. The system checks for details that match between the customer or vendor and the sale or purchase amounts. Taxes are calculated only for the details that match.

If you change the Shipping Method for a transaction, taxes are automatically recalculated. When the Shipping Method is Pickup, the tax schedule for the vendor is compared to the tax schedules for the items. When the Shipping Method is Delivery, the tax schedule for the customer is compared to the tax schedules for the items.

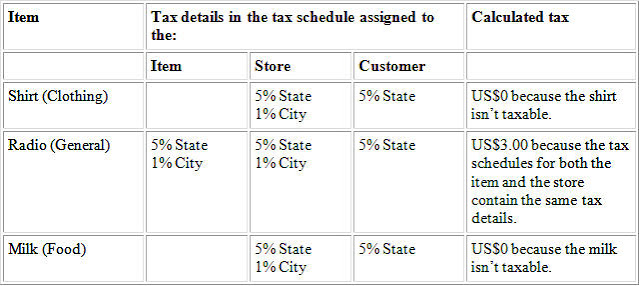

Example - Different Tax Rates for Different Items

A retail store is selling three items to a customer -

- A shirt at US$20.00

- A portable radio at US$50.00

- A liter of milk at US$1.00

The store is located in a town that is subject to 1% city tax and a 5% state tax. However, clothing and food are not taxable in either jurisdiction. Because the customer is purchasing the items at a retail store, the exchange of goods happens in the store's jurisdiction, not the customer's. To calculate the taxes, GP compares the tax schedules that are assigned to each item with the tax schedules assigned to the store and calculates taxes only for the details that match for both.

Example - Different Tax Rates for Different Customers

A mail-order distributor is selling three items to a customer -

- A shirt at US$20.00

- A portable radio at US$50.00

- A box of chocolates at US$10.00

The distributor is located in a town that is subject to 1% city tax and a 5% state tax. The customer is located in another town, where no city taxes apply. Clothing and food are not taxable in either jurisdiction. Because the items are being shipped to the customer, the exchange of goods happens in the customer’s jurisdiction, not the distributor’s. To calculate the taxes, GP compares the tax schedules that are assigned to each item with the tax schedule assigned to the customer and calculates taxes only for the details that match for both.

If you’ve marked the 'Use Shipping Method when Selecting Default Tax Schedule' option in the Company Setup Options window, GP uses the Shipping Method assigned to the transaction to determine where the exchange of goods takes place, and provides the appropriate tax schedule as a default schedule for the transaction.

Like

Like Report

Report

*This post is locked for comments