How To Reverse Fixed Asset Depreciation in Microsoft Dynamics 365?

Views (3081)

Mahmoud Hakim

Mahmoud Hakim

To reverse Fixed Asset Depreciation

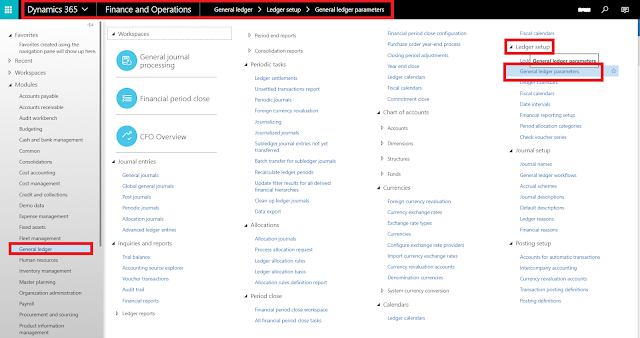

1- Before you reverse a transaction for the first time you must assign a number sequence for the Transaction reversal and Trace number references in the Number sequences area of the General ledger parameters form.

Trace number / Unique key for trace number during reversal of transactions in general ledger, fixed assets accounts receivable, and accounts payable.

go to general ledger/ledger setup/General ledger parameters

go to number sequence tab

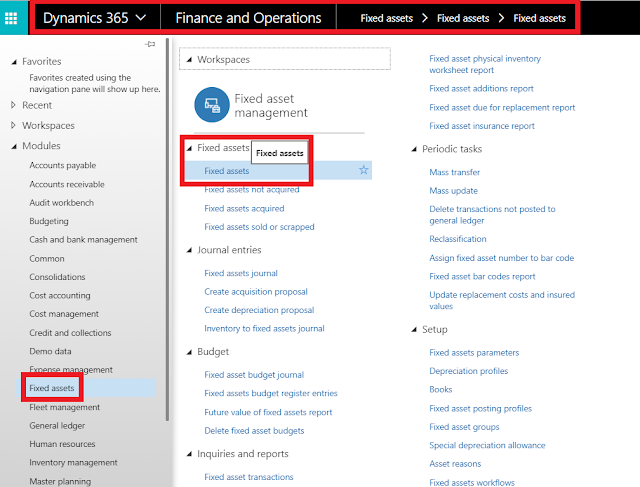

2- Go to Fixed assets / Fixed assets / Fixed assets / Fixed assets

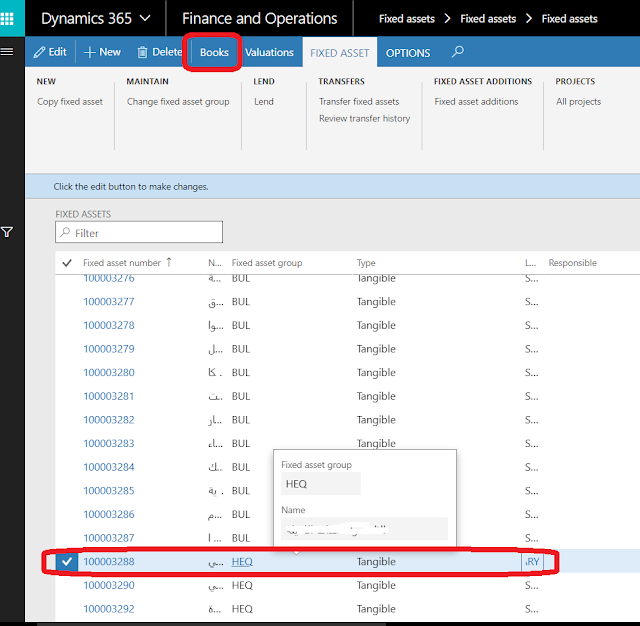

select your Fixed asset and click books

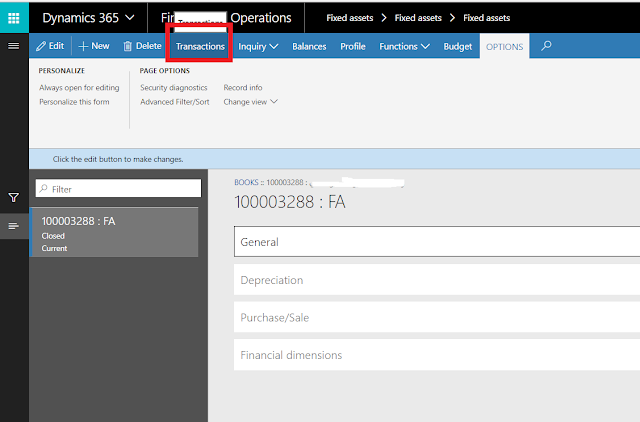

click Transaction

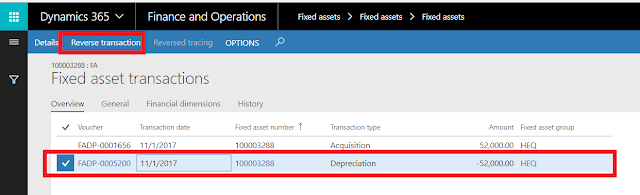

select your transaction and click Reverse transaction

to reverse the transaction, the status must be open

so just change status in BOOK to Open

and click transaction again then click Reverse Transaction

select The reversal date and click OK,

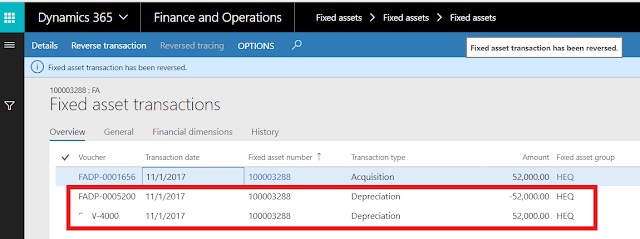

the transaction has been Reversed.

Note::

Fixed asset transaction reversals reset fixed asset field values to their previous values. For example, an asset status might be reset from Open to Not yet acquired, or the Depreciation periods field might be reset from 119 to 120.

you can check more details

https://technet.microsoft.com/en-us/library/aa496782.aspx?f=255&MSPPError=-2147217396

To reverse a large number of depreciation transactions

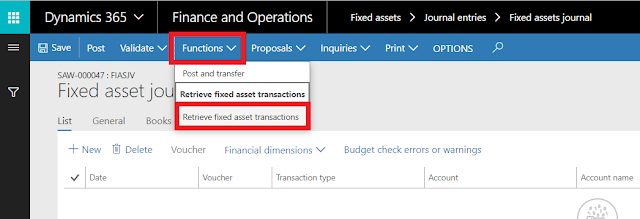

you can create fixed asset journal and use Retrieve fixed asset transactions Function as the below

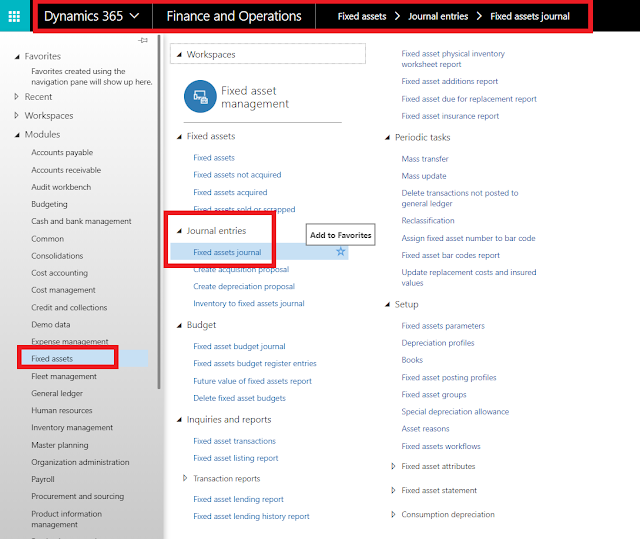

Go to Fixed assets/journal entries / Fixed assets journal

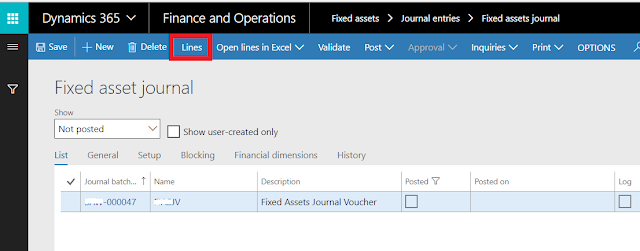

create new Journal

click lines and click function

click Retrieve Fixed asset transaction

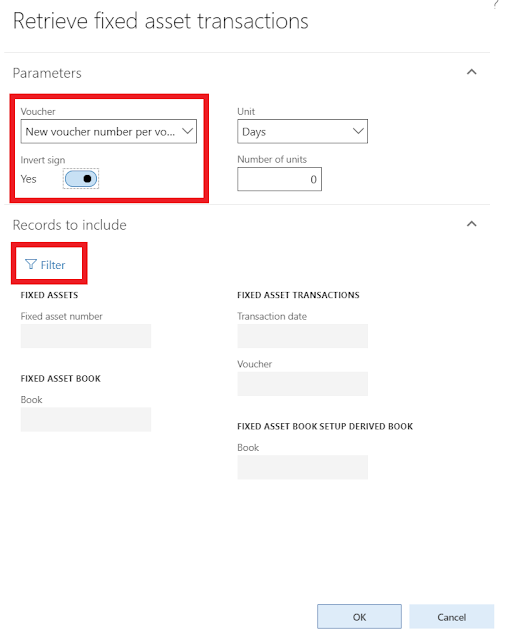

In the voucher field, select ‘New voucher number per voucher’ and also click to select the Invert sign

click Filter to select your transactions

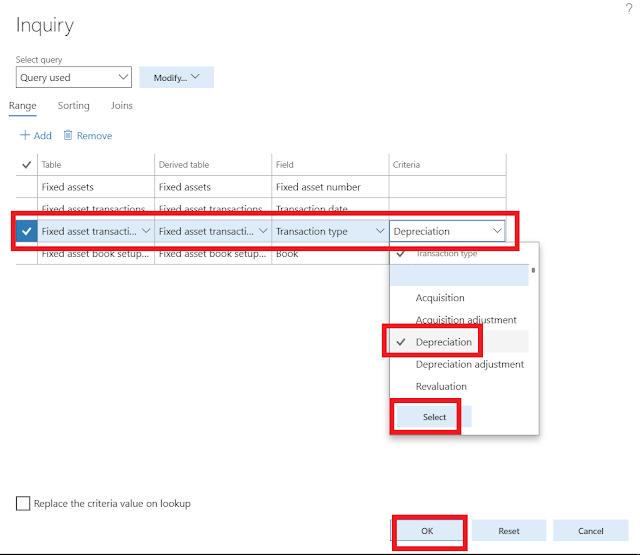

Set criteria like transaction from date to date and transaction type Depreciation, then click OK

Click OK

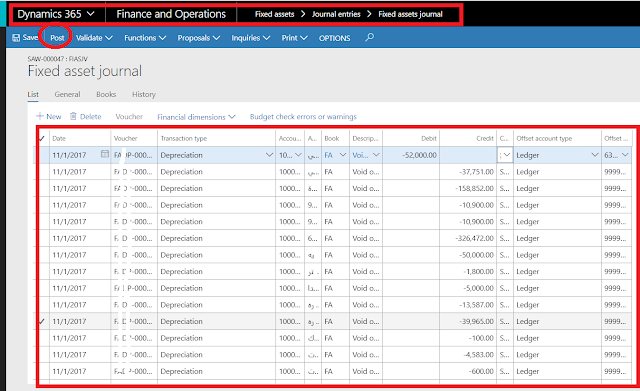

now all transaction with type Depreciation loaded and sign inverted, Just Click Post

just wait until operation complete

Thanks.

1- Before you reverse a transaction for the first time you must assign a number sequence for the Transaction reversal and Trace number references in the Number sequences area of the General ledger parameters form.

Trace number / Unique key for trace number during reversal of transactions in general ledger, fixed assets accounts receivable, and accounts payable.

go to general ledger/ledger setup/General ledger parameters

go to number sequence tab

2- Go to Fixed assets / Fixed assets / Fixed assets / Fixed assets

select your Fixed asset and click books

click Transaction

select your transaction and click Reverse transaction

to reverse the transaction, the status must be open

so just change status in BOOK to Open

and click transaction again then click Reverse Transaction

select The reversal date and click OK,

the transaction has been Reversed.

Note::

Fixed asset transaction reversals reset fixed asset field values to their previous values. For example, an asset status might be reset from Open to Not yet acquired, or the Depreciation periods field might be reset from 119 to 120.

you can check more details

https://technet.microsoft.com/en-us/library/aa496782.aspx?f=255&MSPPError=-2147217396

To reverse a large number of depreciation transactions

you can create fixed asset journal and use Retrieve fixed asset transactions Function as the below

Go to Fixed assets/journal entries / Fixed assets journal

create new Journal

click lines and click function

click Retrieve Fixed asset transaction

In the voucher field, select ‘New voucher number per voucher’ and also click to select the Invert sign

click Filter to select your transactions

Set criteria like transaction from date to date and transaction type Depreciation, then click OK

Click OK

now all transaction with type Depreciation loaded and sign inverted, Just Click Post

just wait until operation complete

Thanks.

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments