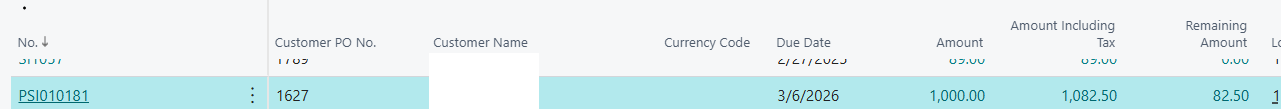

I have a customer invoice for $1,082.50.

The customer paid only $1,000, and the remaining $82.50 will not be received (to be treated as bad debt / write-off / discount).

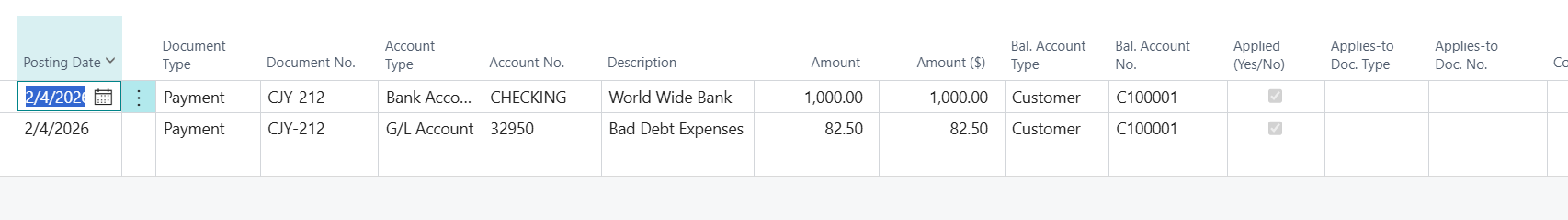

What I Did in Cash Receipt Journal

- Posted a customer payment of $1,000 to the bank account.

- Added a second journal line for $82.50 to a G/L account (Bad Debt Expense).

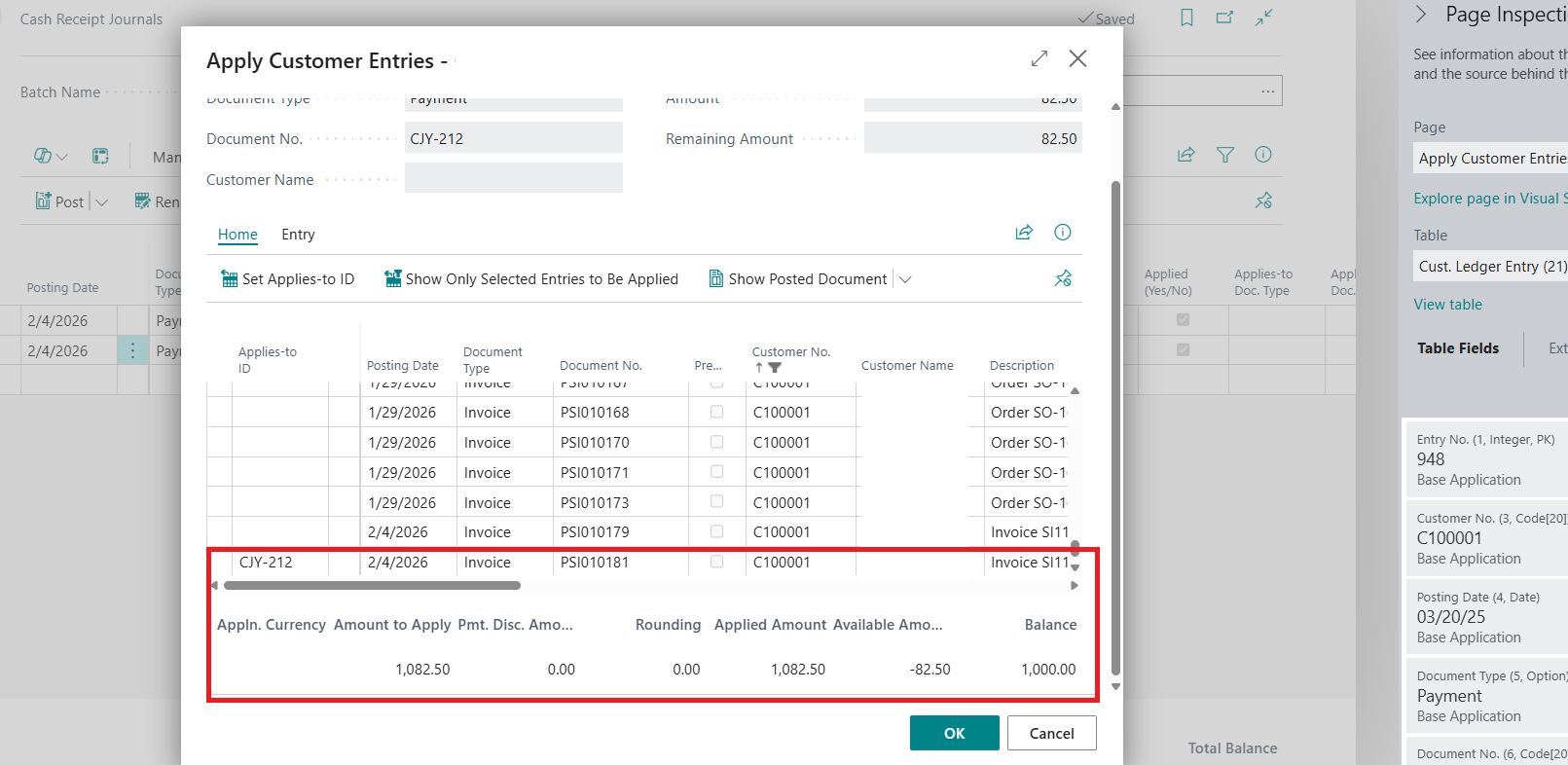

- Applied both lines to the same customer and invoice using Apply Customer Entries.

Both lines are marked as Applied = Yes.

What I Am Expecting

- The invoice should be fully paid and closed

- Customer should have no remaining balance

- Bank account should reflect only $1,000 received

- The $82.50 should be reflected only as an expense (bad debt / write-off)

- No open amount should remain on the customer ledger

What Actually Happens After Posting

- Business Central still shows $82.50 as remaining amount on the invoice

- Customer ledger indicates the customer still owes $82.50

- Even though:

- The bank received only $1,000

- The $82.50 is already posted to a G/L expense

- Both lines are applied to the customer

The Gap / Issue

From an accounting perspective:

- The customer does not owe the remaining amount

- The loss is already recognized in P&L

But from a system perspective: Business Central still treats the invoice as not fully settled

Looking for guidance on:

- Whether this is the expected standard behavior or am I making any mistakes?

- Or if there is a recommended setup / posting method to fully clear the invoice while correctly recording the write-off, without impacting bank reconciliation.

Appreciate insights from anyone who has handled short payments or customer write-offs in Business Central.