RE: Item charge assignment

Hello,

For Sales Tax, yes I would recommend setting up Sales Tax within BC. It is an easy setup:

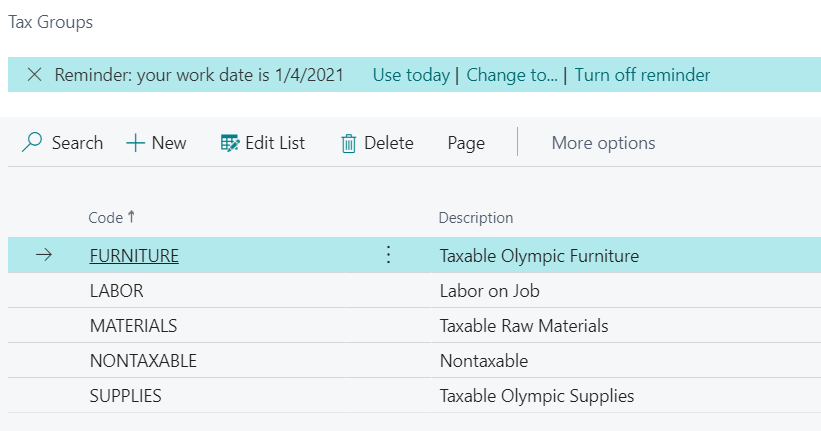

1. Setup your Tax Group Code (i.e. Taxable and Non-Taxable)

2. Setup your Tax Jurisdiction for the State/Local/County that you need to collect Tax for. Here you set the GL Accounts. You also drill into the Jurisdiction Detail to set the Jurisdiction and Tax Group Code relationship and the Effective Date and Sales Tax Rate%.

3. Setup Tax Area Code. This is the Code you define on the Customer Card that brings together all the Jurisdiction Tax Rate that will be imposed.

Now that you have these setup you can attached the Tax Area Code to the Customer Card and the Tax Group Code to your Items/Resources. When you insert a Sales Line BC will calculate the Sales Tax based on this Tax Detail Combination.

As for Shipping Charges, I normally teach my customers to use a Resource to eliminate having to perform Charge(Item) Assignment. You can set a default Unit Price and then change it on entry. You also setup the Tax Group Code for Freight, if applicable in the State.

Hope this helps.

Thanks,

Steve