Can you add an example please, with some informaiton about the scenario and settings and also share which product / country version you use?

I made an example in BC16.3 OnPrem W1 ... and think it works just fine ...

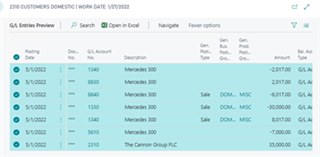

Disposal of FA000010 as per 05th JAN 2022, sold to customer 10000, Sales Amount incl. VAT = 35.000

FA in line 1, - 35.000

Customer in line 2, +35.000

5 days to be calculated for the remaining depreciation (“Depr. until FA Posting Date” = true in FA G/L Journal.

“VAT on Net Disposal Entries” is enabled in Depreciation Book COMPANY

Disposal calculation method in Net

This is what you should get, remaining depreciation = -2.017, VAT is calculated

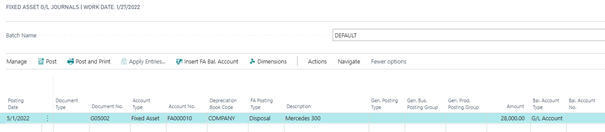

After posting the lines you want to cancel

Open FA Entries and navigate to the Entry of type “Proceeds on Disposal”

Use function “Cancel Entries” and open FA G/L Journal

This is what you should get:

This correct to just get the FA Entries corrected.

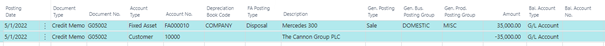

But this is not complete if you also need to get VAT Entry and Customer Ledger Entry corrected.

There fore you have to change / add information.

- Add the VAT Amount (7.000) to the suggested line amount (28.000)

- Add the Posting Type and Groups to get VAT calculated

- Add the Balancing Line for the customer (you can’t have a customer as Bal. Account in the suggested line)

This is what you get:

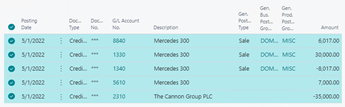

This is the expected result.

You do not get the depreciation for 5 days reversed that have been registered together with the disposal