Hi,

Setup CIS Reverse Charge VAT for our client, which updates the GB VAT Return & GL, correctly.

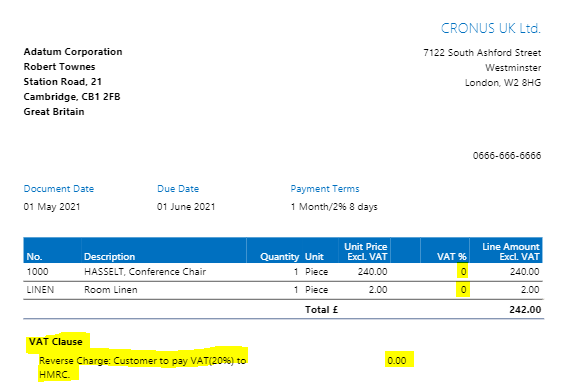

However, the Sales Invoice document doesnt show the VAT Rate used or specify the VAT Value, to be paid to HMRC by the customer. Although there does seem to be a field for it on the report layout.

Please see attached screenshot, i have updated the VAT Clause to specify the VAT Rate used, for the time being.