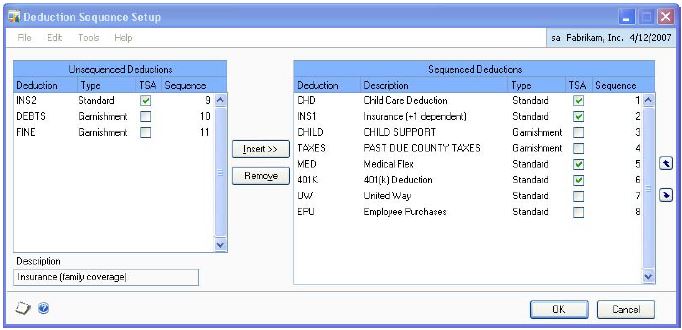

I just want to make sure I'm clear on deduction sequencing, TSAs will always be calculated first, correct? The screenshot below, taken from the Payroll manual, shows "CHILD" and "TAXES" as the 3rd and 4th deductions taken. Just a page above the screenshot, the manual states, "The Payroll system will calculate the TSA deductions from pre-tax wages, regardless of the sequence." That being said, won't GP attempt to take "MED" and "401k" before "CHILD" and "TAXES" since they are sheltered? I attempted to create my own deduction sequence, placing things child support and tax levies first, but ran into sequencing errors while calculating payroll. Once I placed all my TSAs first, the error went away.

*This post is locked for comments

I have the same question (0)