Hi everyone,

I’m trying to understand the intended accounting logic in Business Central around payment discounts, and also how to handle manual discounts at the time of receiving customer payment.

🔹 Scenario

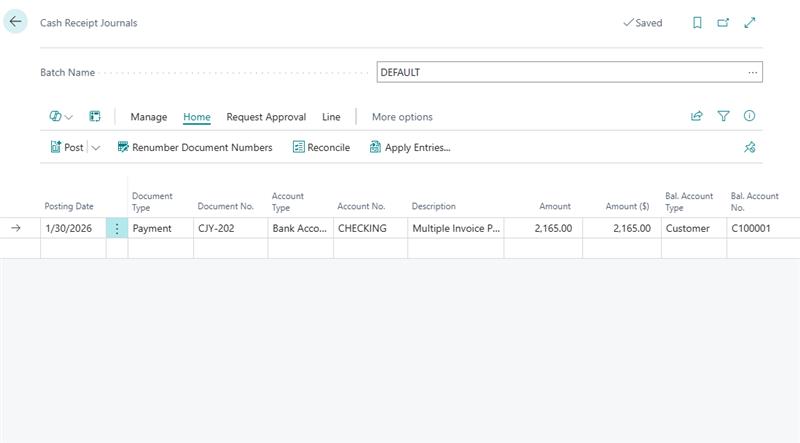

- Two posted customer invoices:

- Invoice 1: $1,082.50

- Invoice 2: $1,082.50

- Total invoice amount = $2,165.00

- Customer payment received = $2,165.00

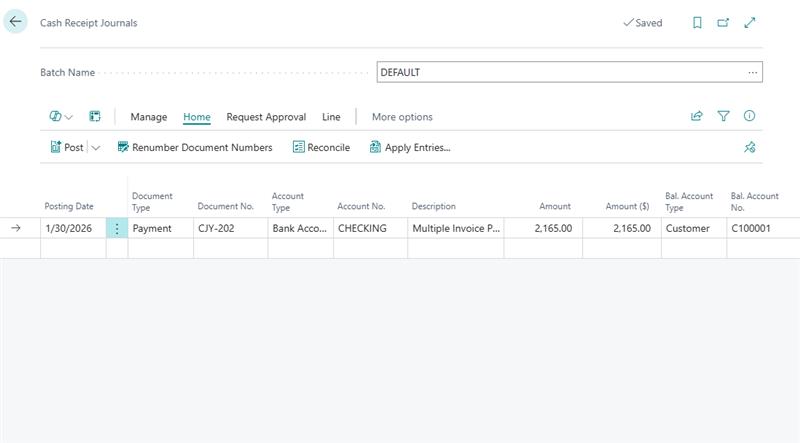

- Payment posted via Cash Receipt Journal

- Payment applied using Apply Customer Entries

Invoice amount and payment amount are exactly the same.

🔹 What Business Central posts

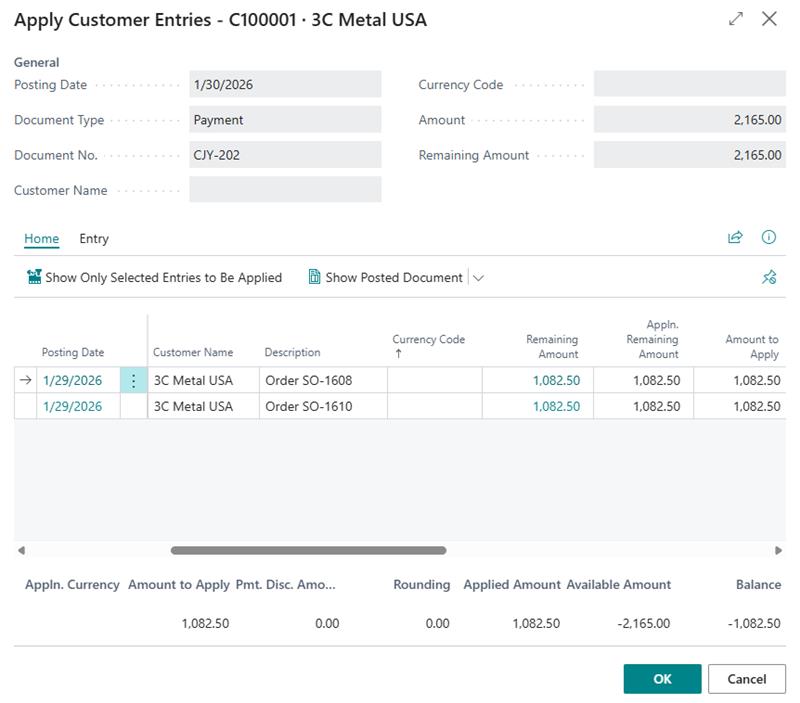

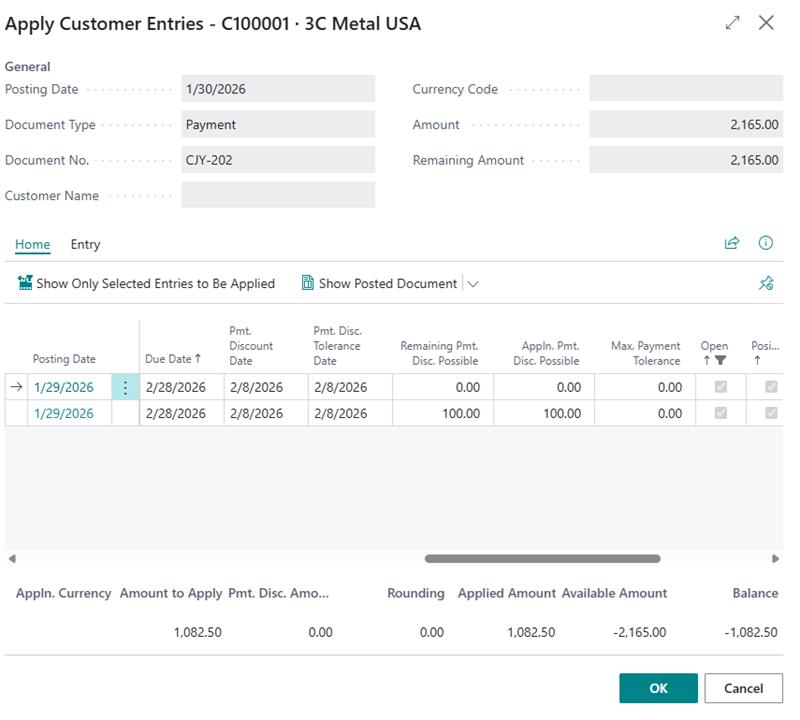

In Apply Customer Entries, the field “Remaining Pmt. Disc. Possible” shows $100.00.

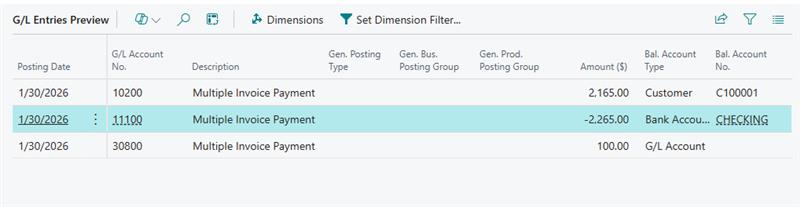

After posting, the G/L Entries show:

| Account |

Amount |

| Bank |

+2,165.00 |

| Accounts Receivable |

-2,265.00 |

| Payment Discount G/L |

+100.00 |

This means:

- A/R is cleared for $2,265.00

- $100.00 is posted to the Payment Discount G/L

- Cash received remains $2,165.00

🔹 What I’m trying to understand (conceptually)

Given that:

- Invoice amount = $2,165.00

- Payment amount = $2,165.00

- There is no short payment

I’m trying to understand:

- How should “Remaining Pmt. Disc. Possible” be interpreted when invoice and payment amounts are equal?

- How does Business Central conceptually justify clearing Accounts Receivable for more than the invoice value?

- Under what design assumption does BC treat the $100 as part of settlement rather than an over-application?

I’m looking to understand the intended system logic, not necessarily challenge the behavior.

🔹 Additional question: manual discount at payment time

My client’s expectation is slightly different:

If a $100 discount is being given at the time of payment, they expect the cash received to be reduced upfront.

In other words, they expect the posting to look like:

| Account |

Amount |

| Bank |

+2,065.00 |

| Accounts Receivable |

-2,165.00 |

| Discount / Adjustment G/L |

+100.00 |

So my additional questions are:

- How can we apply a manual discount at the time of receiving payment in Business Central?

- Is there a supported way to reduce the Bank amount itself (for example via write-off, adjustment line, or discount line) instead of using the automatic payment discount logic?

- What is the recommended approach when the discount is negotiated at payment time and not strictly based on payment terms?