Pricing Method in Microsoft Dynamics CRM Product Catalog All in 1 Explanation

Aileen Gusni

Aileen Gusni

When we want to sell the Product in CRM, we offer the Product and the Salesperson will input their offers in the Opportunity Product Line or Quote Product Line before becoming Order and Invoice.

Of course every Product has its own Price, now, how to link it back to the Opportunity Product Line.

Let’s say Marketing or Product Team has defined the Product Pricing, is there any impact in the Sales Processing?

We are expecting that the Salesperson will not be confused and should sell the Product within the expected range analyzed before by the expert Product Catalog Team and Marketing.

The Product Catalog setting will affect the Opportunity Product default Selling Price Thus, we need to understand first, what is the expectations of the Price and Product Master in hoping their salesperson can sell within the amount with good and profitable selling Price. Price List will become the Guide for salesperson to explore and approach the customer and offer them with price that are mutualism, means that all sides are happy, the Product Team, Marketing Team, Sales Team, and also the Customers.

So, the Pricing is very important in the Sales Process Automation.

Mapping the Business Process Pricing to the CRM Pricing Method is not easy unless you understand how it works and how it will affect the CRM Sales Process.

Now, in this post will mainly explain about how the Pricing Method will affect the basic/default Selling Price in the Sales Process and how important to understand it. It would help the Organization to determine the price either by specific amount, expected margin, and suitable profit markup.

Let’s begin reading this post…

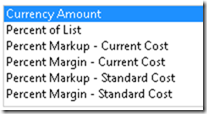

Basically, there are 6 methods of pricing in CRM:

-

Currency Amount

-

Percent of List

-

Percent Markup – Current Cost

-

Percent Margin – Current Cost

-

Percent Markup – Standard Cost

-

Percent Margin – Standard Cost

We will go through one by one, before that let’s we configure the Product Master record here:

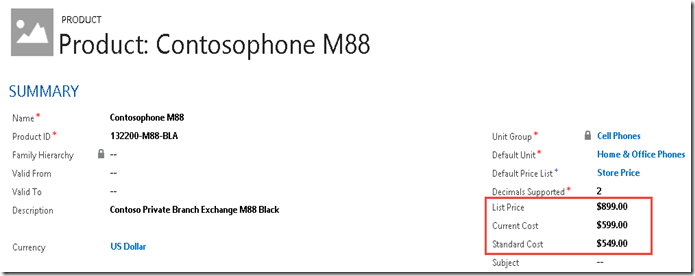

Product Master List Price, Current Cost, and Standard Cost

The definition of Current Cost and Standard Cost are based on your own Organization Pricing and Costing.

So my pricing and costing:

|

Type |

Value ($) |

|

List Price |

899 |

|

Current Cost |

599 |

|

Standard Cost |

549 |

And then we define the Price List Item here, based on each criteria and let’s see how it works and affect the Opportunity Product (and also Quote Product).

There are two type of pricing, Default or User Provided. Here, we will focus on the Default, eventhough you can change the price later if you choose the “User Provided” type, but by default, CRM will give you a default Price per Unit.

Basically the default Price per Unit of each Opportunity Product will follow the rules:

1. Combination of the Price List (defined in the Opportunity header), the Product itself, and the Unit.

This combination will find the correct Price List Item and get the pricing.

2. If the product does not exist in the Price List defined in the Opportunity then CRM will give price per unit based on the Product default Price List. To know more about Default Price List, please check this link out.

http://missdynamicscrm.blogspot.com/2014/07/10-facts-about-default-price-list-in-CRM2011-2013-that-you-might-not-have-noticed.html

3. If the product does not exist in any price list and does not have the Default Price List, CRM will give 0 value and will cause warning and error, this is to let you know how important the Price List in the CRM Sales process if you want to implement the out of the box CRM sales pricing.

Currency Amount

I will give the $888 with Pricing Method = Currency Amount

As you can see the Price Per Unit is not other than $888.00.

We’ve learned how the Currency Amount as one of the CRM pricing method works.

Currency Amount will give exactly the same value from the Amount defined in the respective Product Price List Item

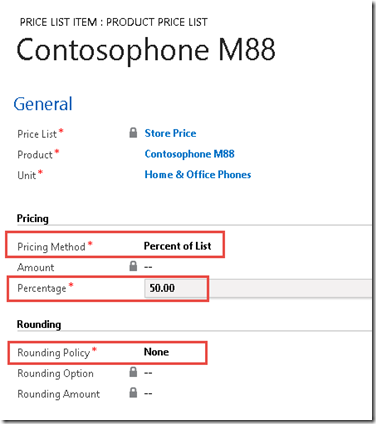

Percent of List

I will set the Pricing Method = Percent of List with Percentage = 50 and the Rounding Policy set to None.

There will be no amount can be set after you change the Pricing Method to Percent of List, instead, you can only set the Percentage from the base you set as the Product List Price.

As we remember, we have defined the List Price before to $899 Value, it will be the base price.

See the result here:

So now it means that the price will be $449.50 was coming from 50% * 899 = 449.50

What if I want to sell higher?

Just put more than 100% like I did here..

Percent Markup vs. Percent Margin

What is the difference between Markup and Margin?

Markup and Margin have different calculation, based on this reference, here is the understanding between those two terms:

- Margin

- The percentage margin is the percentage of the final selling price that is profit.

- Markup

- A markup is what percentage of the cost price do you add on to get the selling price.

These are different, a selling price with a margin of 25% results in more profit than a selling price with a markup of 25%.

In a merchant situation it is probably better to work with margins. This means you can know what percentage of our total income is profit.

How to Calculate Selling Price based on Markup?

Selling Price = (Cost X Markup /100)+ Cost

How to Calculate Selling Price based on Margin?

Selling Price = Cost/((100-Margin)/100)

Thankfully there is a quicker way to work it out.

For a five percent margin, divide the cost price by 0.95.

For a ten percent margin, divide the cost price by 0.9.

For a fifteen percent margin, divide the cost price by 0.85.

For a twenty percent margin, divide the cost price by 0.8.

For a twenty-five percent margin, divide the cost price by 0.75.

For a thirty percent margin, divide the cost price by 0.7.

..and so on…

For a fifty percent margin, divide the cost price by 0.5.

Percent Markup – Current Cost

Now, how about Percent Markup based on Current Cost? Remember the above formula, you will get the Selling Price.

I will set the Pricing Method = Percent Markup – Current Cost with Percentage = 50 and the Rounding Policy set to None.

Same as the previous one, Percent List, you can only set based on percentage, the amount will be calculated automatically based on the Current Cost.

As we remember, we have defined the Current Cost before to $599 Value, it will be the base price.

See the result here:

Selling Price = (Cost X Markup /100)+ Cost

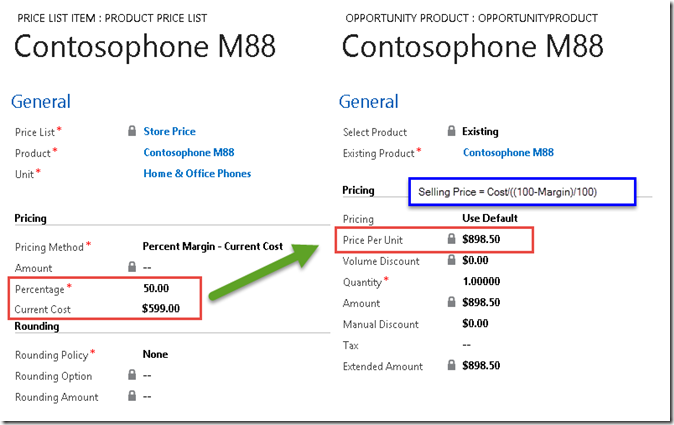

Percent Margin – Current Cost

Now, we are still using the Current Cost, but we want to sell based on Margin.

I will set the Pricing Method = Percent Margin – Current Cost with Percentage = 50 and the Rounding Policy set to None.

Same as the previous one, Percent List, you can only set based on percentage, the amount will be calculated automatically based on the Current Cost.

As we remember, we have defined the Current Cost before to $599 Value, it will be the base price.

See the result here:

Selling Price = Cost/((100-Margin)/100)

For a fifty percent margin, divide the cost price by 0.5.

Percent Markup – Standard Cost

Same as the previous example for the Current Cost, but now, the base is the Standard Cost.

I will set the Pricing Method = Percent Markup – Standard Cost with Percentage = 25 and the Rounding Policy set to None.

Same as the previous one, Percent List, you can only set based on percentage, the amount will be calculated automatically based on the Standard Cost.

As we remember, we have defined the Standard Cost before to $549 Value, it will be the base price.

See the result here:

Selling Price = (Cost X Markup /100)+ Cost

Percent Margin – Standard Cost

Same as the previous example for the Current Cost, but now, the base is the Standard Cost.

Same as the previous one, Percent List, you can only set based on percentage, the amount will be calculated automatically based on the Current Cost.

As we remember, we have defined the Current Cost before to $599 Value, it will be the base price.

See the result here:

Selling Price = Cost/((100-Margin)/100)

For a twenty-five percent margin, divide the cost price by 0.75.

I hope you enjoy this post and make it as reference in the future!

Thank you…Enjoy..

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments