Using a different name on the 1099 forms

L Vail

L Vail

I like clients who plan ahead! This company wants to use a different name on the 1099s other than the ‘Check Name’. You could use this technique on any modern version of Dynamics, but GP 2013 actually has a dedicated address ID for 1099s. That’s where the 1099 address comes from. Sadly, the Vendor Contact is not a field included on the 1099 table.

There was one more twist to this request, they didn’t want to use this alternate name for all 1099 vendors, just for some exceptions. No problem. Here’s what we did:

First, we need a way to determine which 1099 name should be printed. There are several ways to do this. The easiest way is to pick a field on the vendor master and use it as a switch that will tell us if the alternate name should be used. You could use any field, but we normally hijack a field not used for something else. Some likely candidates are:

- Payment Priority

- FOB

- Country

- Phone 3

- UPS Zone

- Tax Registration Number

- Comment 1

- Comment 2

- User Defined 1

- User Defined 2

- Payment Priority

- Revalue Vendor (this only works if you will NEVER use Multicurrency)

- Country Code

You can use any field on the Vendor card, but the above fields are some of the fields I’ve hijacked over the years.

For this example, I’m going to use the Revalue Vendor checkbox field. Often I use this field because it’s a checkbox and it’s easy to work with. You must be sure your never going to want to use multicurrency, but that’s easily managed by switching fields. There are many we can use.

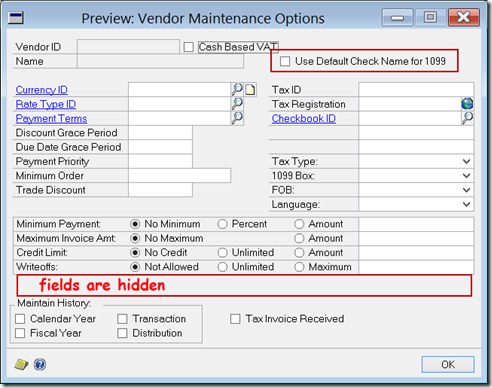

You need to use Modifier and change the prompt, but it’s an obvious choice if multicurrency is out. I changed the checkbox prompt to “Use Default 1099 Check Name”.

Once you’ve decided on the field, it’s time to decide on criteria. I’m going to keep this example easy, but it can be complicated, so long as it’s something Report Writer can calculate. Payment Priority is a checkbox so it’s value is 0 if false and 1 if true. The checkbox defaults to checked, so we need to use ‘unchecked’ to mark an exception vendor. I also make the revaluation radio group invisible. My Vendor Options window looks like this:

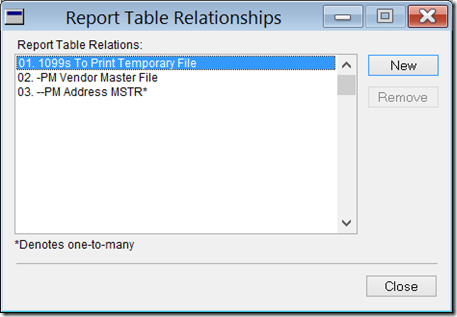

We now need to create a new relationship in Report Writer between the ‘1099s To Print Temporary File’ and the ‘PM Vendor Master File’.

With that relationship set up, you need to add the PM Vendor Master Fie to the report’s tables, and then add the PM Address Master. The Tables window would look similar to the following:

Next, we’re going to add a restriction to the report such that it only selects records from the PM Address MSTR if the Address Code is equal to ‘1099’, or whatever ID you choose. Just keep it consistent.

Now you need to decide which field on the Address window you want to use as the alternate 1099 name. I am going to use ‘Contact Name’. I used modifier to change the field prompt to read ‘Alt 1099 Name’. My modified window looks like this:

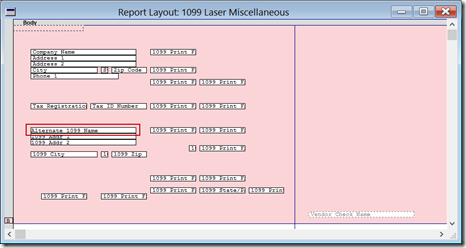

Now we need the conditional calculated field. I’m going to call it Alternate 1099 Name. We are testing for the value of the ‘revalue’ checkbox. If it is 1, we print the check name, if it is 0, we print the alternate name. The formula will look like this:

Finally, modify the report layout and replace the Vendor Check Name field with your Alternate Check Name calculated field. Keep in mind as you do this, that you may have to modify this report each year to keep up with the IRS form layout. My modified report looks like this:

I know it’s hard to see, but there’s a red box around the new calculated field.

I welcome any other workarounds you all have come up with. Also, please let me know if you have any trouble following this article and I’ll modify it for the better.

Until next post!

Leslie Vail

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments