gptip42day - Recalculating Depreciation

Views (5329)

Frank Hamelly | MVP...

Frank Hamelly | MVP...

When you make changes to depreciation-sensitive fields in an asset book record, depreciation needs to be recalculated. Changing any of the following fields requires recalculation –

• Amortization Code

• Amortization Amount

• Averaging Convention

• Cost Basis

• Depreciation Method

• Depreciated-to-Date

• Life-to-Date Depreciation

• Luxury Automobile

• Original Life

• Place-in-Service Date

• Salvage Value

• Switchover

• Year-to-Date Depreciation

• Special Depr Allowance

Selecting ‘Yes’ results in this window appearing –

Reset Life recalculates depreciation from the date the asset was placed in service through the period the asset has been depreciated. Depreciation adjustments will be made for each period, but the depreciation does not have to be posted to General Ledger for each of these periods. You can use the FA General Ledger Posting window to select a range of periods from the financial detail file, then post the entire amount to the period of the recalculation date.

Reset Year calculates a new yearly depreciation rate and uses the new rate to recalculate depreciation from the beginning of the current fiscal year through the period the asset has been depreciated. This depreciation does not have to be posted to General Ledger for each period. You can use the FA General Ledger Posting window to select a range of periods from the financial detail file, then post the entire amount to the period of the recalculation date.

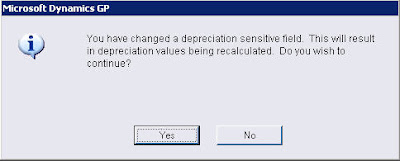

When you change any of these fields then click ‘Save’, this message appears –

* click image to enlarge

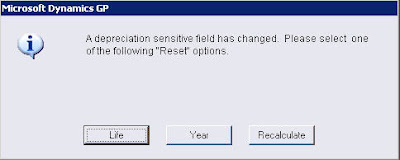

Selecting ‘Yes’ results in this window appearing –

* click image to enlarge

Reset Life recalculates depreciation from the date the asset was placed in service through the period the asset has been depreciated. Depreciation adjustments will be made for each period, but the depreciation does not have to be posted to General Ledger for each of these periods. You can use the FA General Ledger Posting window to select a range of periods from the financial detail file, then post the entire amount to the period of the recalculation date.

Reset Year calculates a new yearly depreciation rate and uses the new rate to recalculate depreciation from the beginning of the current fiscal year through the period the asset has been depreciated. This depreciation does not have to be posted to General Ledger for each period. You can use the FA General Ledger Posting window to select a range of periods from the financial detail file, then post the entire amount to the period of the recalculation date.

Recalculate calculates a new yearly depreciation rate as of the beginning of the current fiscal year. However, calculations are not based on the new rate until the next time depreciation is run on the asset. The current year-to-date depreciation amount is not affected. The difference between the new yearly rate and the current year-to-date depreciation amount is allocated over the remaining periods in the current fiscal year.

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments