GPtip42day - Reopening a closed Fixed Asset fiscal year

Views (5149)

Frank Hamelly | MVP...

Frank Hamelly | MVP...

I'm sure this has never happened to anyone, but if by chance you ever inadvertently close the Current FA Fiscal Year, it will prevent you from posting depreciation into any period in the current fiscal year. How do you get around that? It's pretty easy.

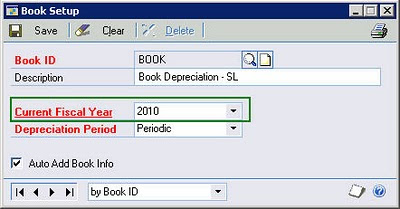

Go Tools>Setup>Fixed Assets>Book and set the Current Fiscal Year back to the prior year.

* click image to enlarge

For instance, let's say you're closing 2009 and you accidentally close 2010 also. At that point, the Current Fiscal Year field will reflect 2011. Just change the Current Fiscal Year back to 2010. You'll now be able to post depreciation into your 2010 periods. The Current Fiscal Year determines whether depreciation is to posted to the current year (depreciation expense account), or a prior fiscal year (prior-year depreciation account).

Be careful though that you don't change the year back to 2009. You don't want to post depreciation into a year that is truly closed!

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments