When processing IRS 1099 forms, we often find adjustments to 1099 amounts are required.

Transaction level adjustments may be required because:

- A portion of the invoice is not a 1099 event (i.e. reimbursable expense.)

- Transactions were processed before the 1099 information was set on the vendor card.

- Transactions are coded to the wrong IRS 1099 Code or a vendor may be subject to multiple 1099 forms types.

1099 Form-Box adjustments may be required because:

- No transaction exists to adjust (i.e. migrated from another system.)

- Mass adjustment to the 1099 amount without having to change each transaction for the vendor.

For companies with Binary Stream Muli-Entity Management (MEM) installed, small variations are noted to adjust 1099s Form-Box by Entity.

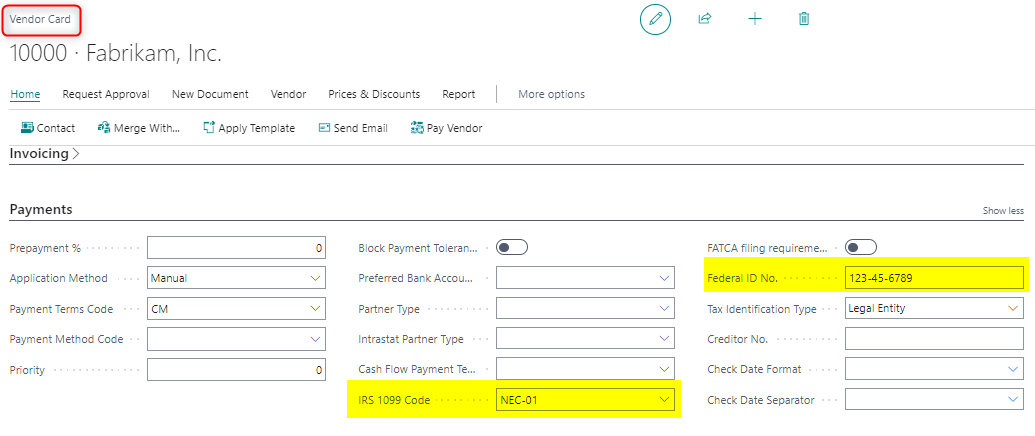

- Vendor: Set up IRS 1099 Default on Vendor Card

Transaction Level 1099 Adjustments

Vendor Ledger Entries: Select Edit List and modify IRS 1099 Code and/or 1099 Amount.

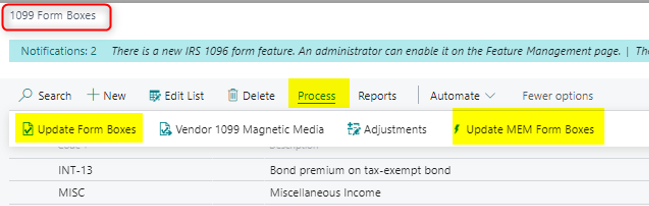

- 1099 Forms Boxes: Select Form and Update Forms Box to update 1099 forms box with the sum of vendor transactions. This must be run each time you update transactions.

For MEM, after Update Form Boxes, select Update MEM Form Boxes to update forms by Entity.

- 1099 Nec (or other form) 2022 or MEM 1099 Nec (or other form) 2022: To print forms with adjustments.

Form-Box Level 1099 Adjustments (See MEM Variation Below)

- 1099 Forms Boxes: Select Update Forms Box to update 1099 forms box, select the relevant form Code and the Adjustments Exists number or Adjustments button.

Enter Vendor No., Year, and Amount of box adjustment.

Note that you can copy/paste multiple lines from Excel into the IRS 1099 Adjustments Window

- 1099 Form Boxes → Update Form Boxes to update the box amount by the total Transaction 1099 Amounts + Adjustments.

- 1099 Nec (or other form) 2022: To print forms with adjustments.

Form-Box Level 1099 Adjustments – MEM Variation

Rather than make form level adjustments in the 1099 Form Box, use the following process to make adjustments to each Entity:

- Dimension → Dimension → Dimension Values → Select Entity → MEM Entity Setup → 1099 Form Box → Select Code → Process > Adjustments or Adjustment Exists value

Edit List and enter manually or copy/paste from Excel.

- Dimension → Dimension → Dimension Values → Select Entity → MEM Entity Setup → 1099 Form Box → Update Form Boxes

And

- Dimension → Dimension → Dimension Values → Select Entity → MEM Entity Setup → 1099 Form Box → Update MEM Form Boxes

For any questions about processing these forms using Dynamics please reach out to us at Support@BondConsultingServices.com or click here to schedule a free consultation with one of our experts.

Like

Like Report

Report

*This post is locked for comments