gptip42day - Year End Close - Sales

Views (2218)

Frank Hamelly | MVP...

Frank Hamelly | MVP...

Closing the Fiscal Year in Sales updates information in the Customer Summary window and Customer Yearly Summary Inquiry window when you select 'Amounts Since Last Close' in the Summary View List in those windows.

Closing the Calendar Year does not affect amounts in those windows but does update information in the Customer Finance Charge Summary window.

In preparation to close the Fiscal Year -

1. Post all transactions for the current year. To enter transactions for a future period, save the transactions in a batch but don't post it until after closing the Fiscal Year.

2. Backup the database.

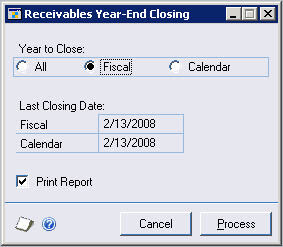

3. Close the Fiscal Year. If your Fiscal and Calendar Years coincide, choose the 'All' radio button in the Year-End Close window. If not, choose the 'Fiscal' radio button. Click 'Process'.

Tools>Routines>Sales>Year-End Close

* click image to enlarge

4. Close the Fiscal Periods for the Sales series (optional). Tools>Setup>Company>Fiscal Periods.

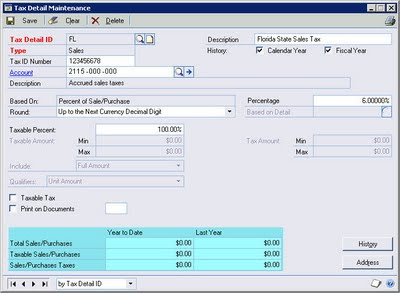

5. Close the sales tax periods for the year (optional). When you close the Tax Year, accumulated totals in the Tax Detail Maintenance window are cleared and transferred to last year's tax totals.

Tools>Setup>Company>Tax Details

* click image to enlarge

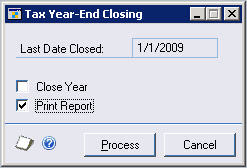

Year-to-date tax totals can then be added for the new Tax Year. Tax amounts entered after closing the Tax Year are added to the new year's totals.

Tools>Routines>Company>Tax Year-End Close

* click image to enlarge

6. If your Fiscal and Calendar Years do not coincide, close the Calendar Year at calendar year-end. Choose the 'Calendar' radio button and click 'Process'.

Tools>Routines>Sales>Year-End Close

* click image to enlarge

7. Make a final backup of your company database.

Tomorrow we'll look at closing the Purchasing series, a process which is very similar to the Sales series close.

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments