Disposition codes in AX 7 / AX 2012 R3

TheAXEffect

TheAXEffect

Hello Readers, It's been a long time since my last post. Hope you all are well !

Today's topic is disposition code in AX 7 / 2012. This is a simple yet very important functionality of AX.

Disposition code is used to specify what action to perform for an item that is returned by the customer. It is assigned during the inspection of an item or at the time of item registration.

There are following disposition actions defined in AX

1. Credit: It is used when we are taking items back from the customer and crediting the customer account with the amount of returned items.

2. Credit only: It is used when we are not taking items back from the customer and only crediting the customer account.

E.g: It is used for low value items where item return is costlier compare to the actual cost of an item or when item is fully damaged so there is no point in taking it back.

3. Returned to customer: It is used when we reject the returned item and return it to the customer

E.g: During inspection, item passed all the required quality standards agreed with the customer.

4. Scrap: Scrap the returned item and credit the customer account

E.g: It is when damaged item is not worth repairing for or can't be repaired.

5. Replace and scrap: Scrap the returned item & replace it with new item and credit the customer account.

6. Replace and credit: Replace the returned item with new item and credit the customer account.

Each disposition code has specific actions which defines the progress of an item once it is returned by the customer.

This blog post explains the system behavior for each disposition action during item return. Click to know more about Item return

Disposition codes

1. Go to Sales and Marketing --> Setup --> Sales order --> Return --> Disposition codes

2. Press New or press Ctrl + N to create new disposition code

3. Add unique code and description

4. Specify the action for disposition code

5. If you want to associate any charges to the specific disposition code then click on Charge Button.

Eg: While returning the item to the customer, if company wants to incur any charges such as Labor charges, handling charges etc. then they can do so by assigning the charges to the disposition code. When the same disposition code use in the transaction, those charges will be applicable to the customer though customer invoice.

How to use disposition codes in the transactions?

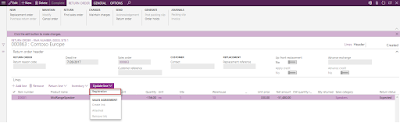

1. Go to Sales and marketing --> Sales return --> All Return orders

2. Click on New

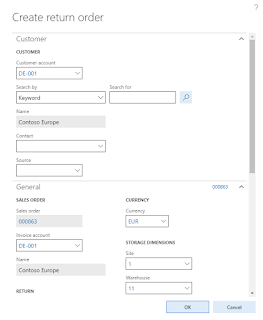

3. Select customer account for which we are initializing the return

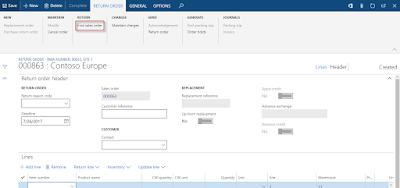

8. Now it is a time for item registration ( It means item arrives at company's /Warehouse's premises but not yet received). This can also be done through Arrival overview.

9. Click on Update line --> Registration

Like

Like Report

Report

*This post is locked for comments