gptip42day - MACRS Depreciation in GP

Views (4857)

Frank Hamelly | MVP...

Frank Hamelly | MVP...

A question I run into rather regularly from users is 'Where do I enter the MACRS tables?'. Well, the short answer is, you don't. GP doesn't utilize MACRS tables for calculating MACRS depreciation. Instead, it uses a combination of the many different depreciation methods and averaging conventions available in GP to simulate MACRS.

Now, for those of you asking, 'What the heck is MACRS?, the short answer is, can you spell IRS? MACRS stands for Modified Accelerated Cost Recovery System, allows for accelerated writeoff of capital (Fixed Asset) costs, was passed into law in 1986 as part of the Tax Reform Act of 1986, and is still in force today.

Now, with that as a little background, let's keep this extremely simple. Suffice it to say that by using the 200% Declining Balance depreciaiton method, Half-Year Convention, and a switch to Straight Line depreciation when advantageous, GP simulates MACRS depreciation. Please see the chart below -

* click image to enlarge

As you can see, in this example, this combination of depreciation settings results in the same depreciation as the MACRS percentages. There are some cases (assets with longer lives) where the GP depreciation may be off by a few dollars at the end of the asset life but it's close enough for government work.

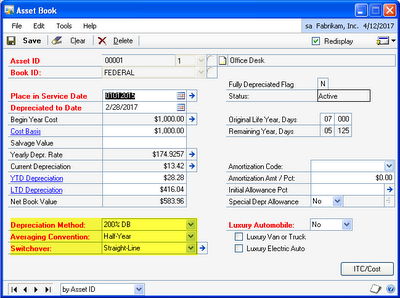

Here's what the depreciation settings look like in the Asset Book window -

* click image to enlarge

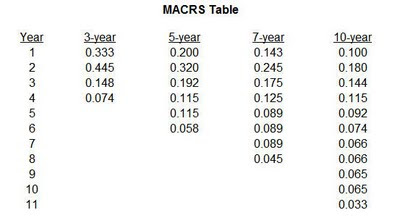

To prove this method, you can run your own tests by setting up a few assets with different lives, run Depreciation Projections (Tools>Routines>Fixed Assets>Projection), and compare the results to the numbers you would get using the MACRS percentage tables, below.

* click image to enlarge

Happy depreciating!

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments