To recognize a revenue or an expense in a period other than the period in which the transaction was posted, standard Microsoft Dynamics 365 Business Central functionality can be used to automatically defer revenue and expenses over a specified schedule.

Let's take a look at one of business scenarios when Unearned Revenue is deferred over 12 months.

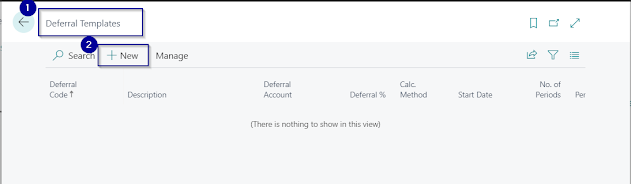

1. Create a new Deferral Card: navigate to Deferral Templates and select New+ from the toolbar.

3. On a newly created Sales Invoice, select a relevant Income Statement G/L Account and define Deferral Code. If Deferral Code column is not available on your interface, please use Personalize to bring it in.

4. Please go to More options - Line- Related Information- Deferral Schedule to view the deferred period amounts to be posted.

4. From here, you can change the Start Date and recalculate amounts accordingly by clicking Calculate Schedule.

IMPORTANT: If the deferral entries span past the current financial year, make sure the year(s) needed have been created in Accounting Periods, otherwise the entry will not be saved.

5. After posting Sales Invoice, you can find posted transaction by navigate to General Ledger Transactions.

The result:

* Sales Revenue (P/L account) is reallocated to the Unearned Revenue (BS account)

* 1/12 of the revenue is recorded in the current month and in each of next 11 months

* All entries will post at once when Sales Invoice is posted

Like

Like Report

Report

*This post is locked for comments