Reverse Transaction(UNDO) – Accounting

RockwithNav

RockwithNav

Hey Readers,

We all are well equipped with the Accounting Reversals and how we are suppose to complete the reverse transaction if we know it has some discrepancies.

Over years I have seen people doing reverse transaction’s the same way as they have been doing over the years like for eg if they have to reverse General Ledger entry transaction then they will navigate to General Ledger Entry and will execute the reversal. Since then I personally have been using G/L Register for the reversal not the individual General Ledger Entry, reason being is I can see the consolidated entries along with the other Source Codes involved in the transaction. Though I was using this but I never recommended this because of limitation of the fact like it wont be doing any reversal if any transaction have sub ledgers involved, sub ledgers mean Vendor Ledger, Customer Ledger, Employee Ledger and so on. So people normally get exasperated when they some error which usually not get.

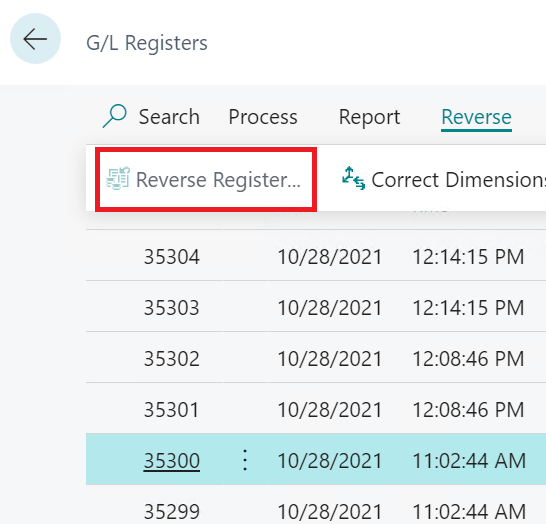

Now after the launch of Business central I can see Microsoft has introduced a very nice feature where in they have completely eliminated the chance’s of confusion. Now under the G/L Register interface if for any specific reason reversal cannot be done then altogether the button will be sitting in disabled mode. So that means end users will have a very understanding like if the button is disabled then reversal cannot be done and if enabled then you can execute the process without any glitch.

As you can see I am checking it for 35300 specific entry and for this transaction it’s disabled means reversal cannot be done and reason being we must be having sub ledgers. If this is enabled means you can do reversal without an issue.

CHEERS

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments