MASTERING PROMISSORY NOTES IN D365 FINANCE: A STEP-BY-STEP GUIDE

Introduction

A promissory note is a financial instrument in which one party formally commits to paying a specific sum of money to another party. This Dynamics 365 Finance feature is versatile and can be effectively used by accounts payable (AP) teams, accounts receivable (AR) teams, treasury departments, legal teams, and vendors. By incorporating promissory notes into their processes, these teams can improve cash flow management and maintain the accuracy of financial records. Process users are as follows:

- AP teams use promissory notes to manage payments to vendors and suppliers. Promissory notes can be issued as a promise to pay at a future date, helping to manage cash flow and payment schedules.

- Finance professionals use promissory notes for cash management, planning, and ensuring that the company meets its financial obligations. They may also use them to secure short-term financing.

- Legal and compliance teams ensure that the issuance and management of promissory notes comply with legal standards and company policies. They handle the documentation and record-keeping associated with promissory notes.

In Dynamics 365 Finance, promissory notes are primarily used by companies and organizations that engage in financial transactions requiring formalized payment agreements.

Note: Dynamics 365 Finance and Operations AR teams might use promissory notes to manage incoming payments from customers. This is common in B2B transactions where credit terms are extended to clients.

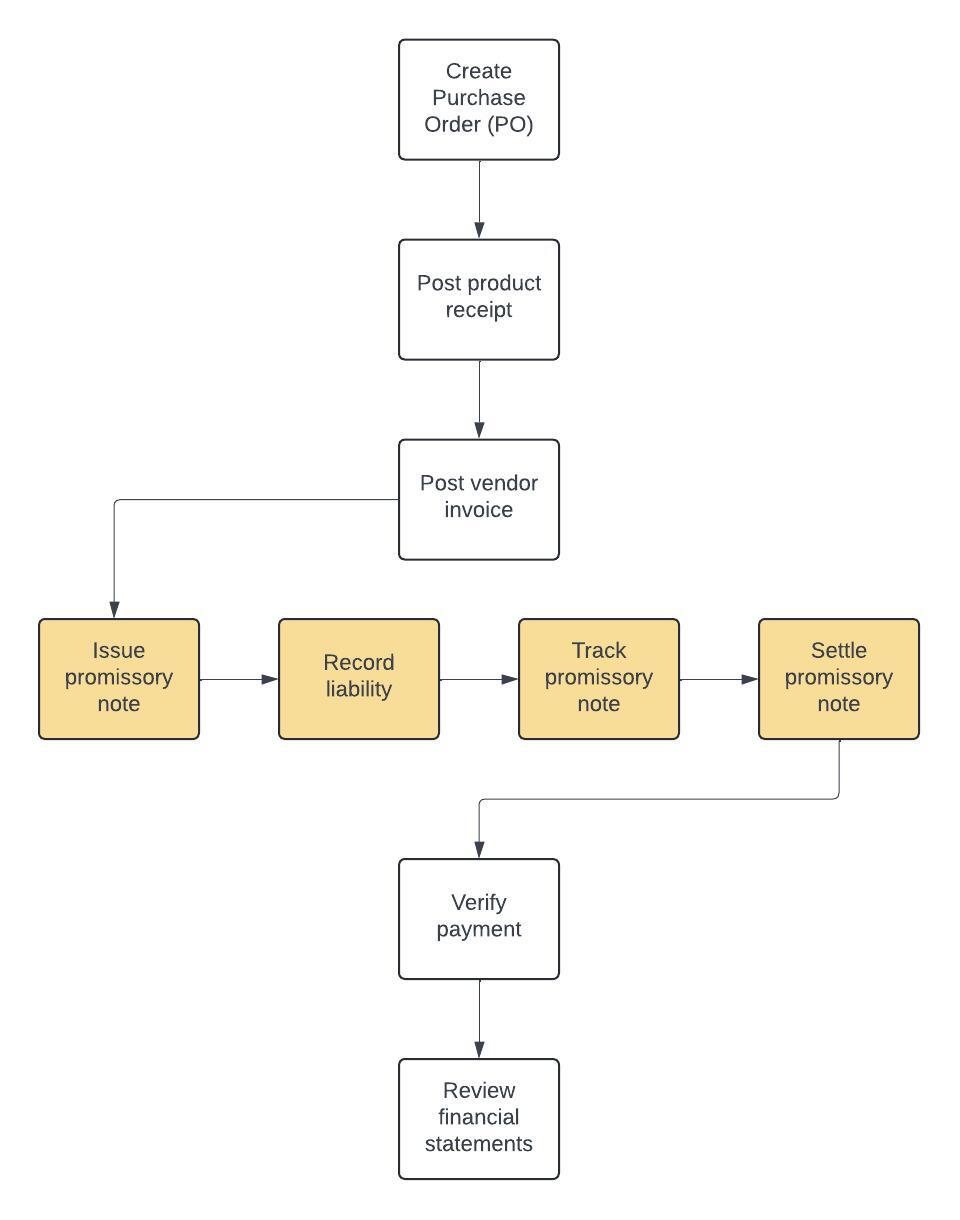

Let's take a look at the overall process flow.

User creates a purchase order for the required goods, materials or services. Upon receiving physical items or services, related product receipt is posted. After receiving items, vendor invoice is posted to document the payable amount to the vendor. So far, everything is as usual.

Issuing promissory note: Instead of immediate payment, user issues a promissory note to the vendor, promising to pay the amount at a future date.

- Record liability: User creates a promissory note as a liability in the accounts payable module.

- Track promissory note: User monitors the promissory note for due dates and any interest accruals.

- Settle promissory note: On the due date, user processes the payment to settle the promissory note.

User verifies that the payment has been successfully recorded and the vendor's account is updated. When the time cones, user generates financial reports to ensure all transactions are accurately reflected in the company's financial statements.

A real life scenario

Contoso purchases $10,000 worth of inventory from Acme. Instead of making immediate payment, Contoso issues a promissory note promising to pay the amount in 60 days. While due date approaches, Contoso makes sure that funds are available. When the due date comes, Contoso settles the promissory note and issues the payment.

...

Read the full post

HERE!