I need some help in understanding the reducing balance depreciation calculation.

I acquired an asset at 65000 INR using Purchase order. I put it into service on 2nd September 2025. The life of the asset is 36 months.

The rate of depreciation in the books is 63.16%. There is no scrap value that I have defined.

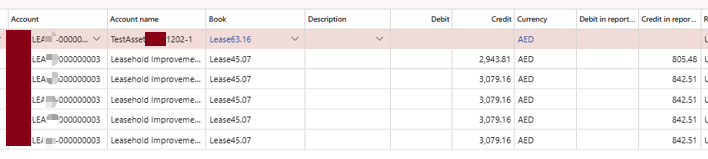

I want to calculate the depreciation from 2nd September 2025 to 31st Jan 2026. From my calculation, it comes to 17096.46, but when I ran a depreciation proposal, the value shows was 17,433.90 with the summary as below:

Am I missing out anything in the calculation?

For Dubai entity that we have, I got the calculation as below. The asset details remain the same as above:

I would really appreciate if someone can explain the calculation process for asset depreciation?