Hello BC-Forum,

I want a depreciation of 30% of the bookvalue every year. Example:

2744 * 30% = 823.20 / 12 months = 68.60 per month depreciation. Next year:

1920.80 * 30% = 576.24 / 12 months = 48.02 per month depreciation. And so on.

I tried different depreciation methods, but I cannot get to 68.60 per month. So I tried user defined with a depreciation table code. See my print screens.

When I try to fill in an ending date, I get an error which is understandable because of the choosen method.

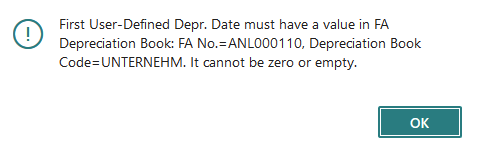

When I calculate depreciation I get the error: fill in a date...

How can I get 30% per Year of book value (823.20) and 68.60 per month automatically booked every month?

Thanks in advance!

Greetings,

John