Your guidance is very helpfull.

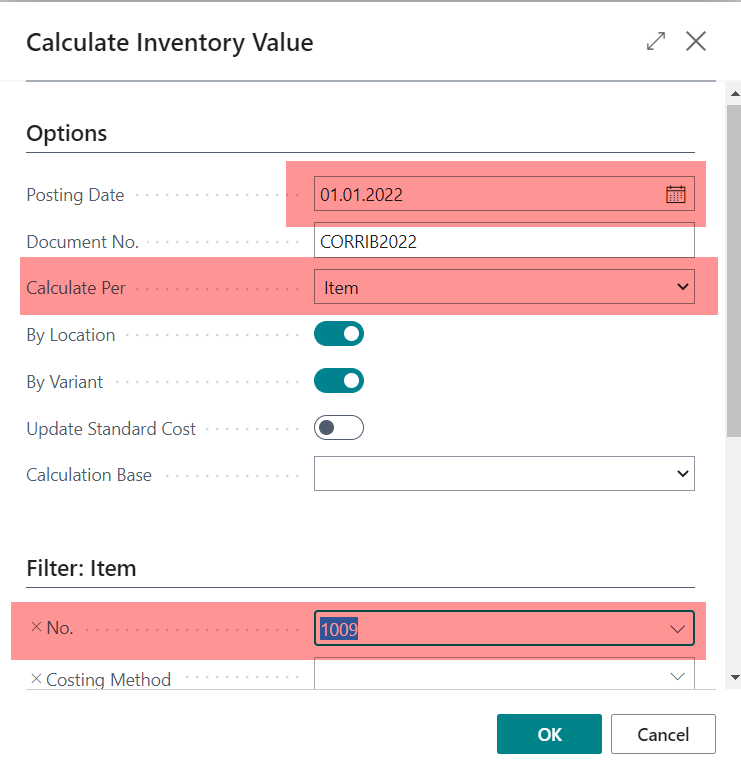

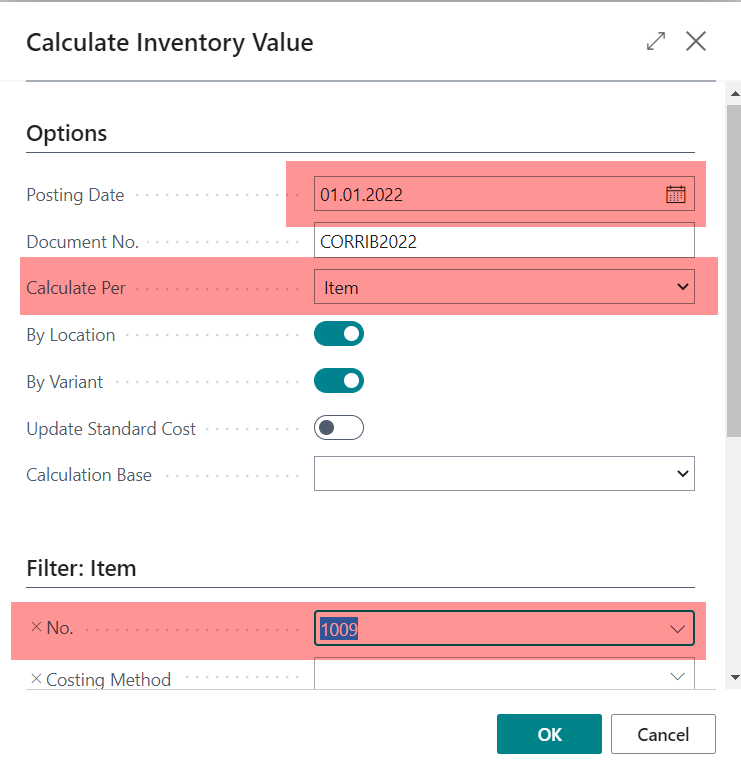

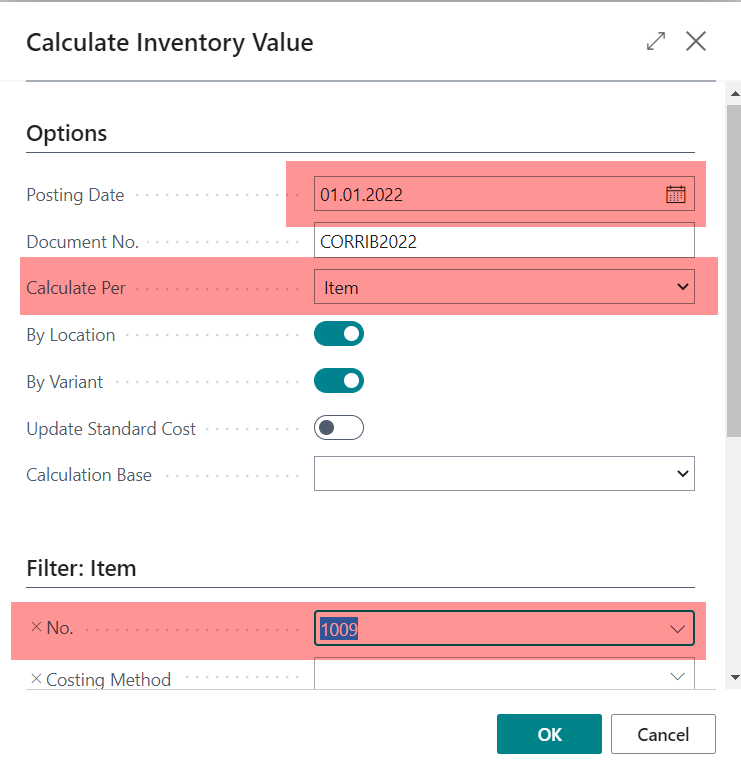

Now, you can check that process with my screenshot.

Best Regards, [quote user="Inge M. Bruvik"]

If the inventory you had on the date of the opening balance is soled then the actual cost of these sales transactions will be updated when you do the item revaluation as long as you run automatic cost adjustment. If you do not run automatic cost adjustment you will need to run cost adjustment manually after you do the item revaluation.

If there are still remaining inventory from your opening balance then the inventory value will be updated after the revaluation. Your purchase invoices should not be effected.

Also make sure that when you run the item revaluation you have to select the option to calculate by item and not by item ledger.

Also make sure to chose the correct date and i also recommend you evaluate one item at the time so you can check that you get the expected outcome before you move on to the next item. The will also make it easier to have a good audit trail for the financial effect of your transactions.

Here you can see the effect on the item value entries after i first posted incoming balance and then reevaluated the cost at a later stage

And here the effect on a sales transaction posted several months after the incoming balance was posted but still consuming the inventory that was part of my incoming balance.

So the financial effect is all taken care of. But if your finance people have reported for the effected periods their reports will be effected as well. So you need to have a dialog with them around that.

I hope this was understandable. If not let me know.

[/quote][quote user="Inge M. Bruvik"]

If the inventory you had on the date of the opening balance is soled then the actual cost of these sales transactions will be updated when you do the item revaluation as long as you run automatic cost adjustment. If you do not run automatic cost adjustment you will need to run cost adjustment manually after you do the item revaluation.

If there are still remaining inventory from your opening balance then the inventory value will be updated after the revaluation. Your purchase invoices should not be effected.

Also make sure that when you run the item revaluation you have to select the option to calculate by item and not by item ledger.

Also make sure to chose the correct date and i also recommend you evaluate one item at the time so you can check that you get the expected outcome before you move on to the next item. The will also make it easier to have a good audit trail for the financial effect of your transactions.

Here you can see the effect on the item value entries after i first posted incoming balance and then reevaluated the cost at a later stage

And here the effect on a sales transaction posted several months after the incoming balance was posted but still consuming the inventory that was part of my incoming balance.

So the financial effect is all taken care of. But if your finance people have reported for the effected periods their reports will be effected as well. So you need to have a dialog with them around that.

I hope this was understandable. If not let me know.

[/quote][quote user="Inge M. Bruvik"]

If the inventory you had on the date of the opening balance is soled then the actual cost of these sales transactions will be updated when you do the item revaluation as long as you run automatic cost adjustment. If you do not run automatic cost adjustment you will need to run cost adjustment manually after you do the item revaluation.

If there are still remaining inventory from your opening balance then the inventory value will be updated after the revaluation. Your purchase invoices should not be effected.

Also make sure that when you run the item revaluation you have to select the option to calculate by item and not by item ledger.

Also make sure to chose the correct date and i also recommend you evaluate one item at the time so you can check that you get the expected outcome before you move on to the next item. The will also make it easier to have a good audit trail for the financial effect of your transactions.

Here you can see the effect on the item value entries after i first posted incoming balance and then reevaluated the cost at a later stage

And here the effect on a sales transaction posted several months after the incoming balance was posted but still consuming the inventory that was part of my incoming balance.

So the financial effect is all taken care of. But if your finance people have reported for the effected periods their reports will be effected as well. So you need to have a dialog with them around that.

I hope this was understandable. If not let me know.

[/quote]