Samantha,

The additional Deprecation Books entries, you are correct they are NOT integrated to the G/L. You will need to do a few more steps to both create the Acquisition and book Depreciation within those Tax Books.

First, in the Tax Depreciation Book, on the Duplication Fast Tab, did you turn on Part of Duplication List? Turn this on.

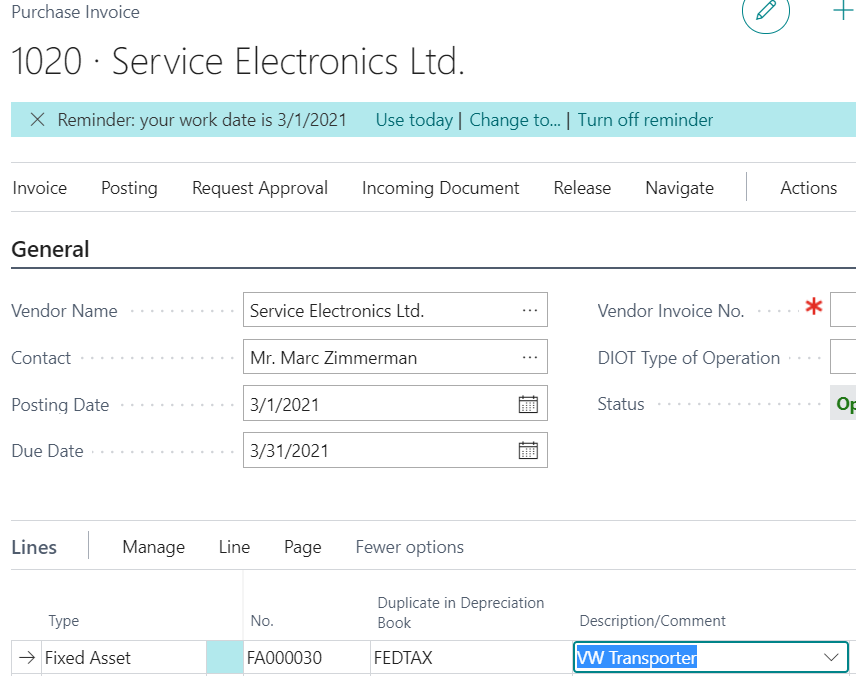

On the Purchase Line, make sure the field Duplicate in Depreciation Book is there. Enter the Tax Book you want to duplicate into and the Acquisition Cost will post there.

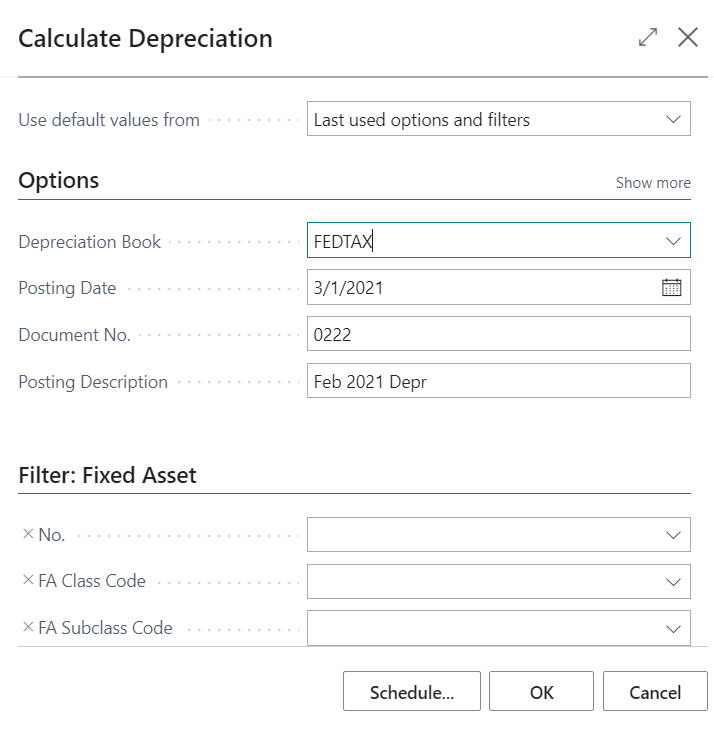

As for Depreciation, you will need to run Depreciation for the Tax Book separately, since this will use the FA Journal to record depreciation for that Tax Book. If you have more than 1 Tax Book, you run them separately.

Hope this helps.

Thanks,

Steve