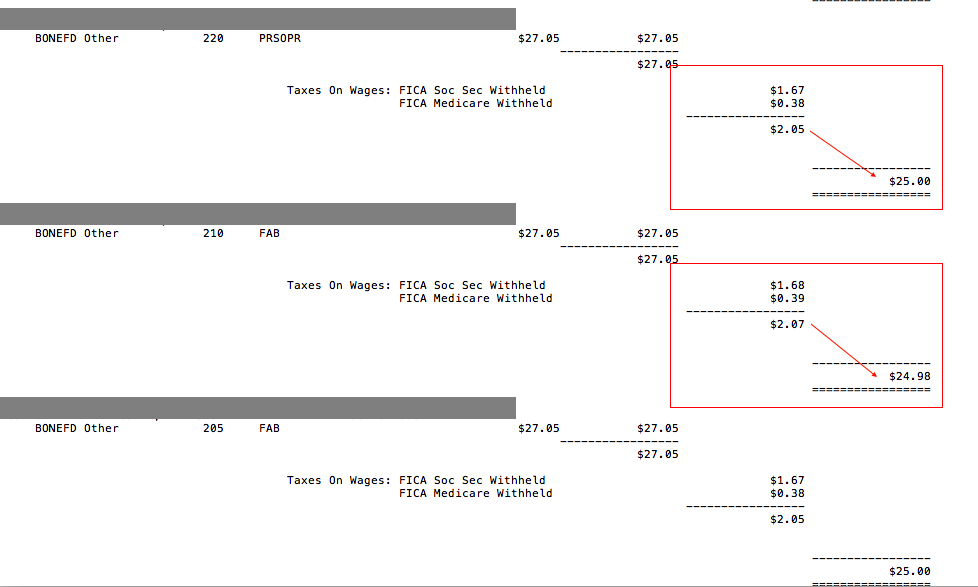

I have a situation where we pay a bonus to the employees. The amount of the bonus is the same for all the employees $27.05 but the FICA SS and FICA Med is different for some employees. What will cause this difference? I check all setup and it seems to be correct.

*This post is locked for comments

I have the same question (0)