Hello Dears,

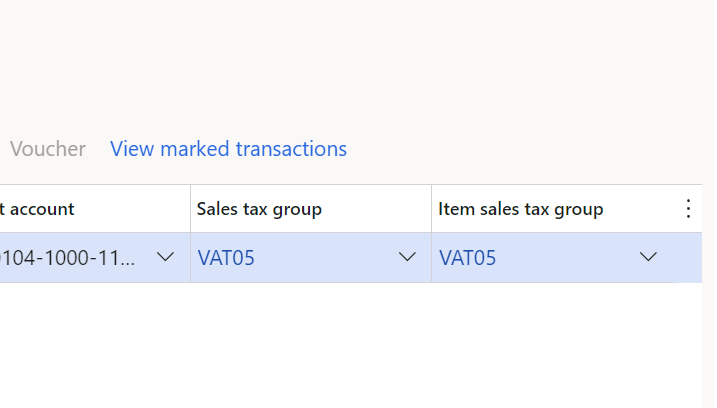

in the vendor invoice journal page, do we have any setup to update the item sales tax group with the same value of the sales tax group as attached?

sometime the users forgot to add the item sales tax group, I know that we can setup the sales tax group in the vendor card, but the users always forget to add the item sales tax group to the lines of journal. So, the tax doesn't affect with tax normally.

i need a setup to add the item sales tax group to the journal once the sales tax group is there.

thanks for continuously support.