Hi:

As shown below, I at first received a Posting Preview error in a Purchase Journal when I placed a positive amount of $500.00 within the "Amount" field.

The error stated that a negative amount is required.

This surprised me, because everyone knows that a debit to an expense account is a positive amount.

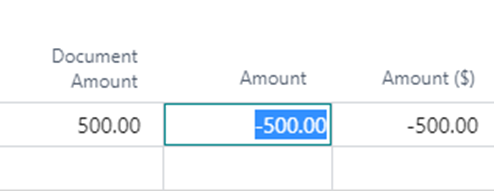

Anyway, after deleting the record, re-entering it, and placing a positive $500.00 instead into the "Document Amount" field, the negative amounts filled in automatically within the "Amount" and "Amount ($)" field. This is shown, within the screenshot below.

Then, I was able to successfully post.

So, should I only concern myself with "Document Amount" when creating an invoice in the Purchase Journal?

Why would the Purchase Journal want a negative amount?

Thanks!

John