Suresh,

You could revalue juts the Receipt entry to include missing costs for that positive entry. Here are the steps:

If you would like to revalue a single positive entry only, you will need to use the Revaluation Journal differently. First, find the “Entry No.” you want to revalue in the “Item Ledger Entries” list for this item.

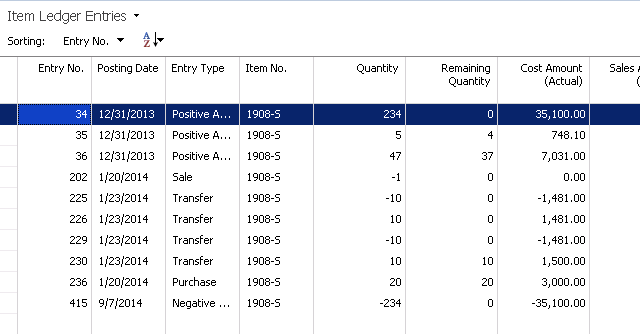

I want to revalue the positive adjustment posted on 12/31/2013. In the Item Ledger Entries list below, the Entry No. for that Item Ledger Entry is 34:

Figure 5 – Locate the Entry No. of interest in the Item Ledger Entries list

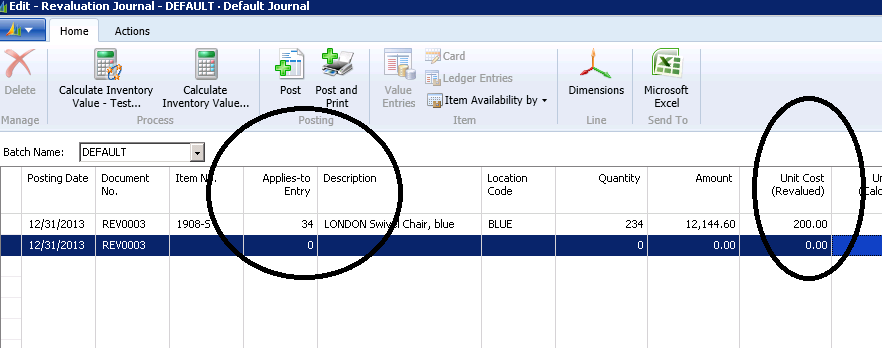

Next, populate the Revaluation Journal by manually entering the item number, then the Entry No. Finally, enter the “Unit Cost (Revalued)” and post:

Figure 6 – Enter the item number, the Entry Number, and the Unit Cost (Revalued)

You may encounter the error regarding being out of the allowed posting date range. In this case, you might need to change the General Ledger Setup date range, the User Setup date range, and/or reopen an inventory period. The challenge here is that the General Ledger posting may be in a prior accounting period. If this is the case, you would likely post a General Journal that moves the accounting effect out of the closed period into the current period.

Hope this helps.

Thanks,

Steve