Hi All,

We have some costing confusion. I've boiled it down to a simple example that I can still not understand.

We are using FIFO, and we add a flat labour rate as a surcharge in the costing sheet for things we make.

We are investigating the proper sub contract solution, but for now we are using an alternate method.

Take an assembly, with a single component. Component is $2, and we need to 5 of them to make the assembly. So when we make one, the cost of the assembly is $12.50 (labour is 25%). this is good.

To facilitate our work around for sub contracting, we amend the production BOM to consume the raw material (components) as well as the sub contracted assembly brought in against a purchase order. We "buy" the subcontracted part "assembly" for $5.

So, the works order consumes 5 components at $2 each, as well as the assembly we purchased for $5. The physical cost is correct at $17.50 each.

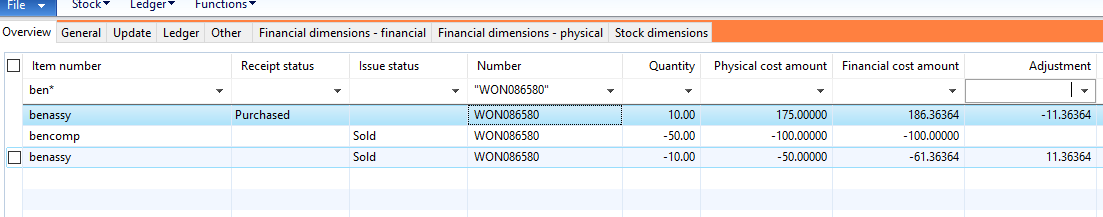

However, the financial cost is wrong, and this causes problem as an active price is generated, as well as stamped against the item cost. This means pending costs are using the over inflated cost. The adjustment made subsequently does fix this however. The financial cost when the works order was for 10 is 186.36364, but it is adjusted to the physical cost, which is 175 as expected. We would like to know where the extra 11.36364 came from!

I realise purchasing the assembly, to consume in a works order making the same assembly is somewhat crazy, but until we have the proper solution licked this is what we have to do.

Can anyone enlighten me?