Hello,

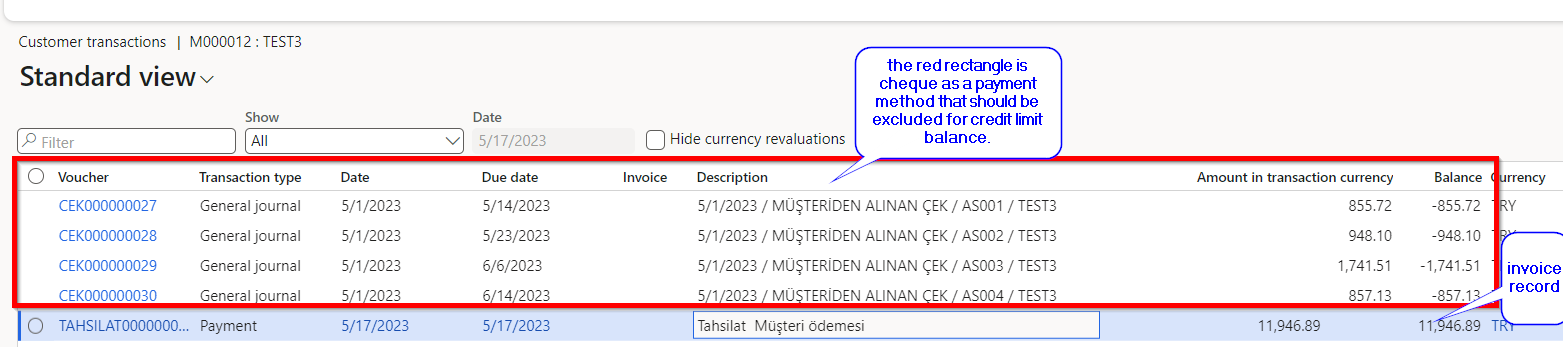

A customer we are on the project requires not adding cheques (as a collection mean) on credit limit calculation.

For example: A client has a credit limit defined on master data. The customer gives cheque for an invoice as a collection type. Cheques have a due date so actually it is not a collection type like cash or bank. I mean not immediately occurs.

Therefore, the cheque should not be seen as credit balance on masterdata in order to prevent to increasing credit limit balance.

do you have any experience like this?