Y6685.Report2.pngou can undo depreciation using the Depreciate Asset window (Microsoft Dynamics GP menu >> Tools >> Routines >> Fixed Assets >> Depreciate One Asset). Just enter the target date in past.

You can undo depreciation for one asset at time. You cannot undo depreciation for multiple assets at a time.

Also, you can only undo deprecation of asset for current year only. You will need to change the year in Book set up window for backing out depreciation of last year.

Summarized steps are:

1. Use the Depreciate Asset window (Microsoft Dynamics GP menu >> Tools >> Routines >> Fixed Assets >> Depreciate One Asset) to undo depreciation up to 12/31/2010.

2. Change the Current Fiscal Year to 2010 using Book Setup window(Microsoft Dynamics GP menu >> Tools >> Setup >> Fixed Assets >> Book)

3. Use the Depreciate Asset window (Microsoft Dynamics GP menu >> Tools >> Routines >> Fixed Assets >> Depreciate One Asset) to undo depreciation up to Placed In Service Date.(I am assuming assets were placed in service in 2010)

4. Change back the Current Fiscal Year to 2011 Book Setup window(Microsoft Dynamics GP menu >> Tools >> Setup >> Fixed Assets >> Book)

5. Post the undo transaction to GL using the Fixed Assets General Ledger Posting window(Microsoft Dynamics GP menu >> Tools >> Routines >> Fixed Assets >> GL Posting)

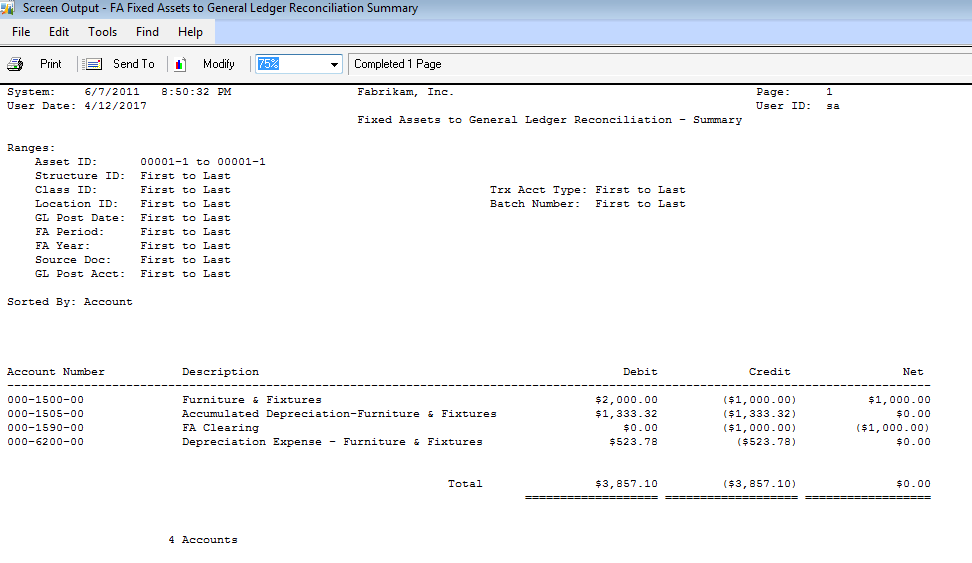

6. Use the Fixed Assets to General Ledger Reconciliation report (Reports >> Fixed Assets >> Activity >> select Fixed Assets to General Ledger Reconciliation) to get any other transactions details

a. Generate report summary format for assets you want to delete

b. You will need to reverse the account balance displayed in report. I have added screenshots of the report below

7. Enter the GL adjust for transaction prepared in last steps

8. Delete the asset using Asset Delete Utility window (Microsoft Dynamics GP menu >> Tools >> Utilities >> Fixed Assets >> Delete)

You can test these steps in Test environment before making changes in live company.

Screenshots

Note: depreciation and accumulated depreciation are zero after undo depreciation.

Rubal,

http://dynamicsgphelp.com/