Hi,

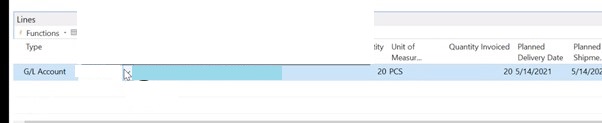

So one of my companies in Navision doesn't have any items in it. My users decided to do sales using GL Account.

I checked with my accountants and she said that it is fine.

However, me being the lack of knowledge in accountings, I would like to ask:

1.What is the difference when doing sales order using Items, which involve inventory and GL Accounts, which doesn't matter if you have zero items in inventories.

2. How does doing Sales Order by using GL accounts works conpares to doing sales order base on how much items you have in your inventories?

Thank you!