A4186.Purchasing.png"/resized-image.ashx/__size/550x0/__key/CommunityServer-Components-UserFiles/00-00-04-03-61-Attached+Files/1031.Receiving.png" border="0" />

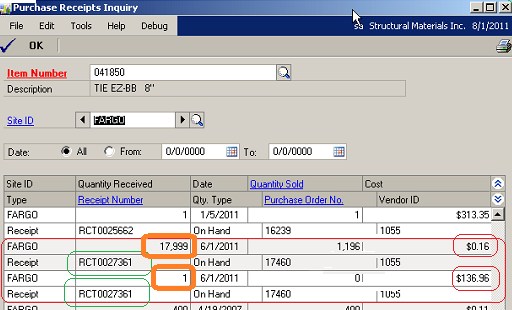

Screenshot of purchase Receipts Inquiry:

*This post is locked for comments

I have the same question (0)