Hi!

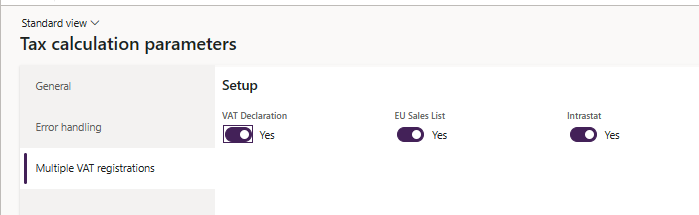

We have enabled the functionality for Multiple tax exempt number under the Tax calculation parameters for reporting:

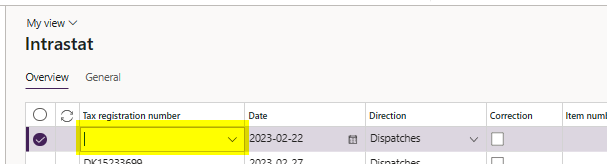

I have tried to follow all the possible instructions, but I cannot make the VAT declaration and Intrastat to work when this is enabled. The EU sales list works!. For some reason the Tax registration number (setup on the legal entity VATID) is blank for the Intrastat reporting:

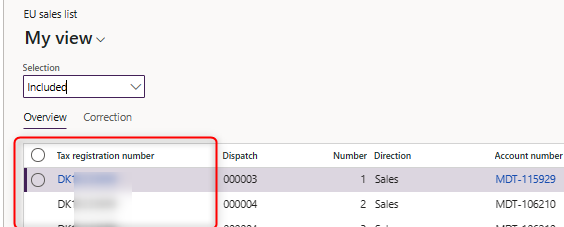

But not when I run the EU sales list:

Same goes for the VAT declaration- I cannot run the VAT declaration with Multiple tax number functionality, but when I turn it off I can.

Has anyone experienced the same issue or do you know if the Intrastat/Tax declaration is taking the Tax registration from a different place?

Thanks!

Emma