RE: Differences between posted sales tax and ledgertransvoucher

Hi,

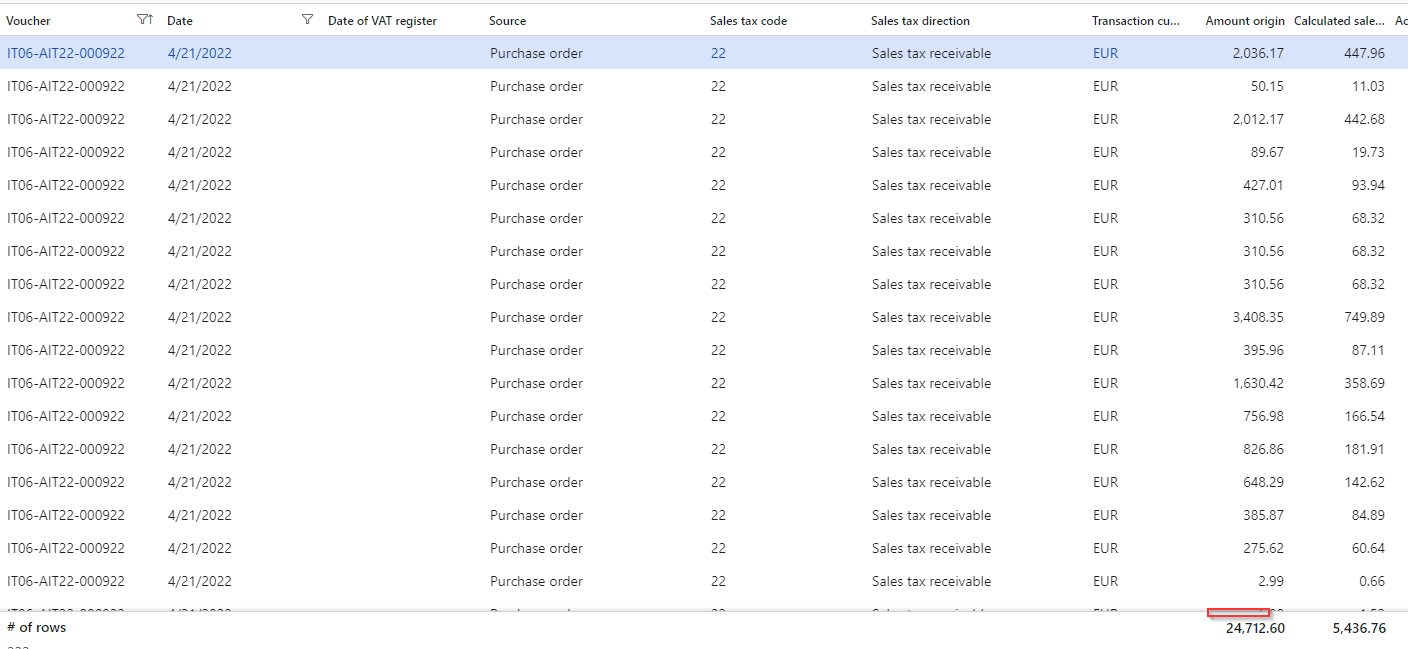

posted sales tax of invoice

Amount origin 24712.60 EUR

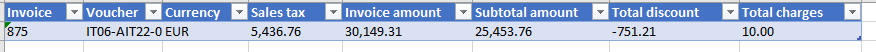

Vendor Invoice totals

Subtotal - vendor discount + tot.charges =24712.55

Accounting currency = reporting currency = EUR

Version 10.0.24

[quote user="Alireza.Eshaghzadeh"]

Hi,

Can you provide us with more info?

-Screenshots of vendor invoice and sales tax.

-Accounting currency and reporting currency

-Which product version do you use?

[/quote]

[quote user="Alireza.Eshaghzadeh"]

Hi,

Can you provide us with more info?

-Screenshots of vendor invoice and sales tax.

-Accounting currency and reporting currency

-Which product version do you use?

[/quote]