Denys,

The Item you are purchasing is the Costing Method = Standard Cost? If yes, let me explain what happens when setting a purchased item to Costing Method = Standard Cost:

Setting the Costing Method = Standard Cost means the Purchased Item has a fixed unit cost for a period of time and/or your company costing policy is standard cost for purchased items. An item's unit cost is preset based on estimated. When the actual cost is realized later, the standard cost must be adjusted to the actual cost through variance values. It is used in repetitive manufacturing, to value the costs of direct material, direct labor, and manufacturing overhead.

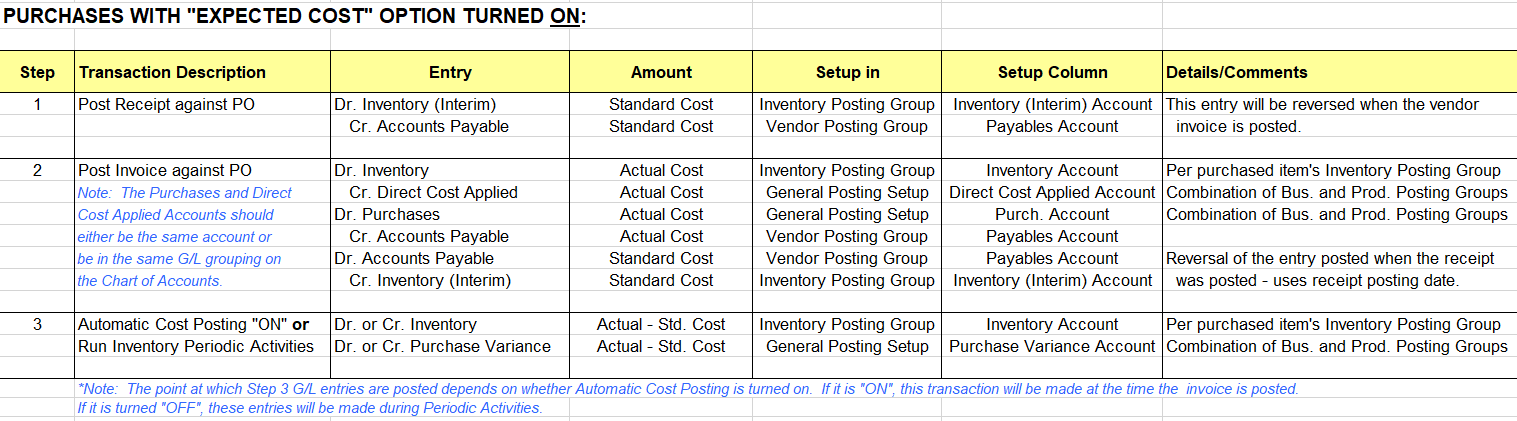

Now the entries are as follows, with a Costing Method = Standard Cost (NOTE: Your Charge(Item) entry against the Items Receipt is also considered part of the Standard so the 200.00 exceeded the Direct Cost and recorded a Purchase Variance.

Now, not knowing your Item, I think you had a Standard Cost = 3505.94. The 15,000 minus 11,494.06 reflects this. The 11,494.06 becomes the Purchase Variance. The Inbound Freight will also become a Variance as it exceeds the total Standard Cost of the single units Direct Cost.

Hope this helps.

Thanks,

Steve