Josh,

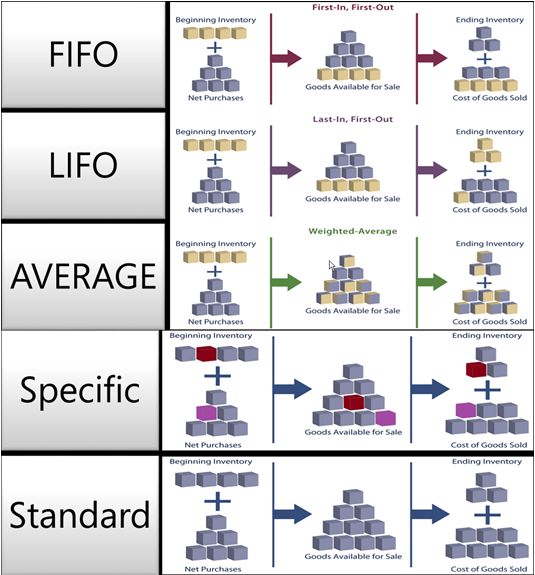

The costing method determines if an actual or a budgeted value is capitalized and used in the cost calculation. Together with the posting date and sequence, the costing method also influences how the cost flow is recorded. The following methods are supported in Dynamics NAV:

The following image shows how costs flow through the inventory for each costing method.

Costing methods differ in the way that they value inventory decreases and if they use actual cost or standard cost as the valuation base. The following table explains the different characteristics. (The LIFO method is excluded, as it is very similar to the FIFO method.)

Example

This section gives examples of how different costing methods affect inventory value.

The following table shows the inventory increases and decreases that the examples are based on.

Note

The resulting quantity in inventory is zero. Consequently, the inventory value must also be zero, regardless of the costing method.

Effect of Costing Methods on Valuing Inventory Increases

FIFO/LIFO/Average/Specific

For items with costing methods that use actual cost as the valuation base (FIFO, LIFO, Average, or Specific), inventory increases are valued at the item’s acquisition cost.

The following table shows how inventory increases are valued for all costing methods except Standard.

Standard

For items using the Standard costing method, inventory increases are valued at the item’s current standard cost.

The following table shows how inventory increases are valued for the Standard costing method.

Effect of Costing Methods on Valuing Inventory Decreases

FIFO

For items using the FIFO costing method, items that were purchased first are always sold first (entry numbers 3, 2, and 1 in this example). Accordingly, inventory decreases are valued by taking the value of the first inventory increase.

COGS is calculated using the value of the first inventory acquisitions.

The following table shows how inventory decreases are valued for the FIFO costing method.

LIFO

For items using the LIFO costing method, items that were purchased most recently are always sold first (entry numbers 3, 2, and 1 in this example). Accordingly, inventory decreases are valued by taking the value of the last inventory increase.

COGS is calculated using the value of the most recent inventory acquisitions.

The following table shows how inventory decreases are valued for the LIFO costing method.

Average

For items using the Average costing method, inventory decreases are valued by calculating a weighted average of the remaining inventory on the last day of the average cost period in which the inventory decrease was posted.

The following table shows how inventory decreases are valued for the Average costing method.

Standard

For items using the Standard costing method, inventory decreases are valued similar to the FIFO costing method, except valuation is based on a standard cost, not on the actual cost.

The following table shows how inventory decreases are valued for the Standard costing method.

Specific

Costing methods make an assumption about how cost flows from an inventory increase to an inventory decrease. However, if more accurate information about the cost flow exists, then you can override this assumption by creating a fixed application between entries. A fixed application creates a link between an inventory decrease and a specific inventory increase and directs the cost flow accordingly.

For items using the Specific costing method, inventory decreases are valued according to the inventory increase that it is linked to by the fixed application.

The following table shows how inventory decreases are valued for the Specific costing method.