In the new Asset leasing module i cannot see anywhere to setup sales tax options relating to the lease, typically when leasing assets in the UK VAT is applied to the rental values

The payment schedules used to create the transaction either to a ledger account or to a vendor account have no mention of sales tax

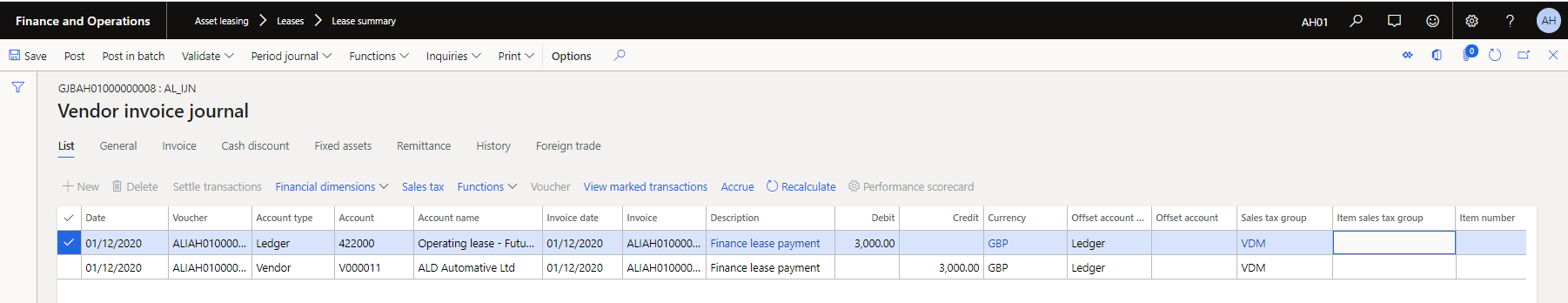

The journal created from the payment schedule may not be edited but is not populating the item sales tax group, the sales tax group being populated from the vendor

Is there anywhere to add the sales tax details relating to the lease