Hi

Consider a scenario like I have got a sales order from one of my customers and the payment is received for that order.

The order is not yet shipped to the customer's address but it's ready for shipment [picked]. So now the customer wants to make changes or wants to refund his/her order. In this case, we will charge a customer an adjustment fee because of the cost incurred on wrapping, getting things ready, etc.

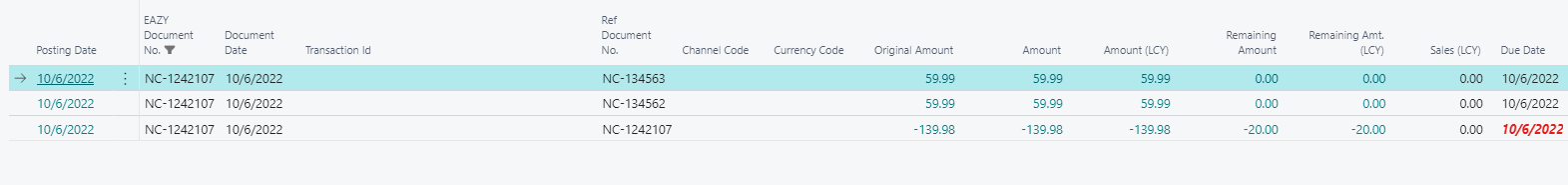

The payment received was 139.98 and then we made two partial refunds with an adjustment fee. Finally, we are coming up with 20 as the remaining amount.

Any idea of how to cater this remaining amount difference appearing in customer ledger entries?

Thanks

bilal