Hi all

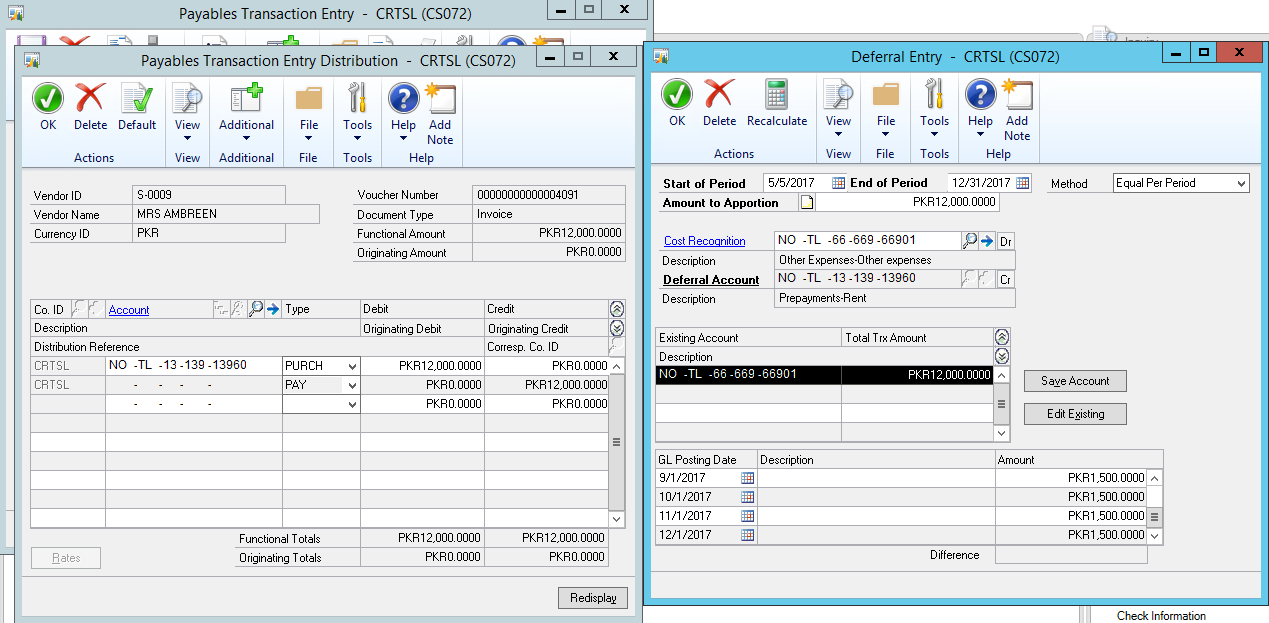

We have setup deferrals for revenue and expense. For the time being we want to use it for prepaid rents. when I go to purchasing> transaction> transaction entry> and make the invoice for the full amount for the year i.e 12,000. then I go to distribution tab and open the payable distribution window. At default their are two distributions assigned to vendor purchase and accounts payable.

I changed the first distribution and enter their deferral account. then hit the additional>deferral and entered the data that is okay. when I came to payable distribution window here I don't know what to do next. what distribution account need to be given in payables type. Because it does not make sense that I am debiting the 12,000 for whole 12 periods that is going to deferral and at the same time I am crediting the payable which is not basically payable right now. In the above scenario how to make payment entry and to credit cash as I paid to the landlord rent in advance. Below are the images of all steps from setup to making the entries.

Please help, with how to apply debit credit concepts in this specific scenario, in getting out of this

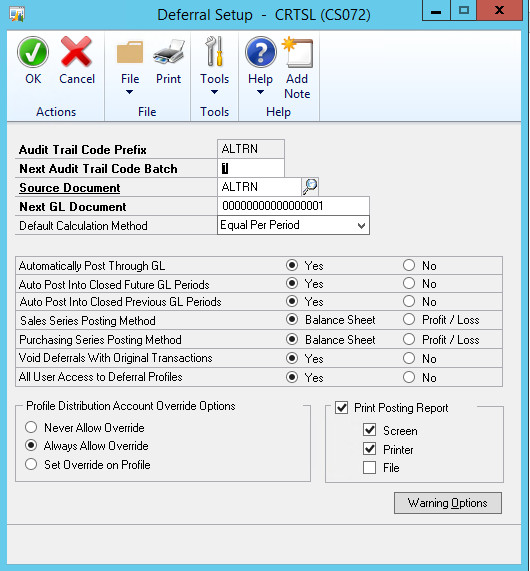

Below is the setup for deferrals

Below is the setup for Deferral profile for prepaid rent

Transactions Details

*This post is locked for comments

I have the same question (0)