Greetings and salutations:

Our not-for-profit is setting up BC as our new ERP, which requires a bit of "retrofitting" to make it do things the way we need it to work. I've quizzed several of you about how to make it do fund accounting and I think we're making good progress there.

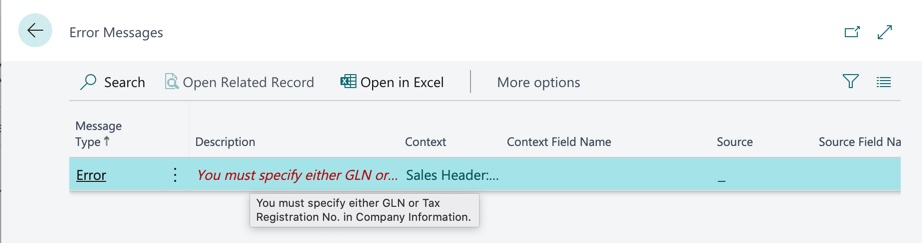

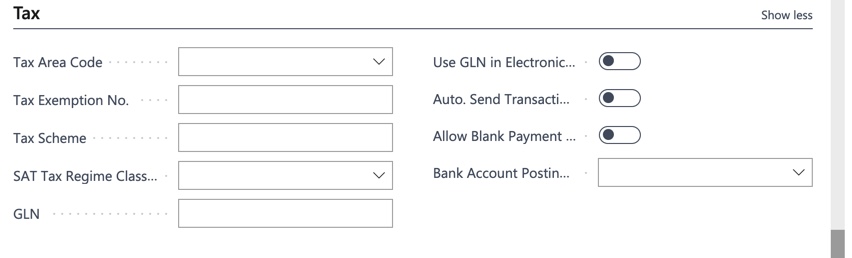

Now, on what I think is a much smaller matter, I'm puzzled over how to set up the tax info on our Company Information. We do not sell anything. We are a tax exempt 501(c)3 organization. We receive donations for supporting humanitarian and religious projects in Peru, but we will use the sales functionality to handle donations (as if they were sales). So, to post a sales invoice or post to the G/L we have to have some info in the tax section of the Company Information card. Specifically, we get an error saying that we must either add a Tax Exemption Number or a GLN. We don't have either. What info in the tax section are we actually required to supply to make it work? Any suggestions on solving the particular error?