This is not an easy one ... if you want to correct

Fixed Asset Ledger

Customer Ledger

VAT

I have to admit that this process is not very comfortable and includes some manual steps.

However it is the recommended way and it should be okay because usually such wrong disposals shouldn’t happen very often.

First of all: A Credit Memo is not the recommended way to correct the wrong disposal!

However … if you need to print a Credit Memo for some unknown reasons this is the only way to do it, except writing and printing a credit memo outside NAV.

The main point for corrections in Fixed Assets is the usage of function “Cancel Entries” (Report 5686)

“Cancel Entries” can be started from the FA Ledger Entry form.

Don’t use the “Reverse Transaction” function – this won’t correct the FA Ledger Entries correctly.

Please take a look at this “Cancel Entries” report and the Online Help for this report.

Here is what this report does (from the Online Help):

<<<

This function copies the fixed asset ledger entries that you want to cancel to a journal. If the fixed asset(s) are integrated with the general ledger, the program transfers the entries to the FA G/L journal. Otherwise, the program transfers the entries to the FA journal. You can then post the journal or adjust the entries before posting, if necessary. The fixed asset ledger entries are then removed from the FA Ledger Entries window and are posted to the FA Error Ledger Entries window.

>>>

In fact the fixed asset ledger entries won’t be physically “moved” from one table to another. The report just changes the existing fixed asset ledger entries and marks them as “Canceled Entries”. This way after this process finished you won’t see them using the form 5604, FA Ledger Entries anymore but you’ll find them in form 5605, FA Error Ledger Entries.

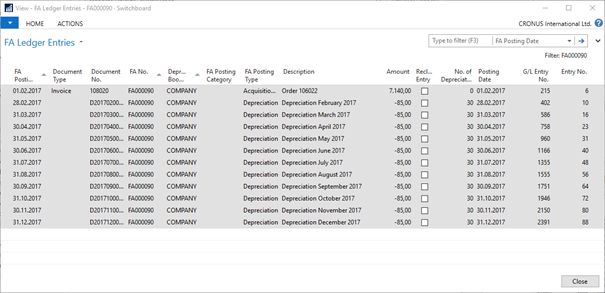

The following is an example form NAV 2017 or so, but he steps shoudl still be the same

If a credit memo has been created in a first attempt to correct this situation:

After the sales credit memo has been posted the G/L Entries, VAT Entries and Customer Ledger Entries should have been reversed/balanced. But there are still wrong FA Ledger Entries.

So the needed steps are:

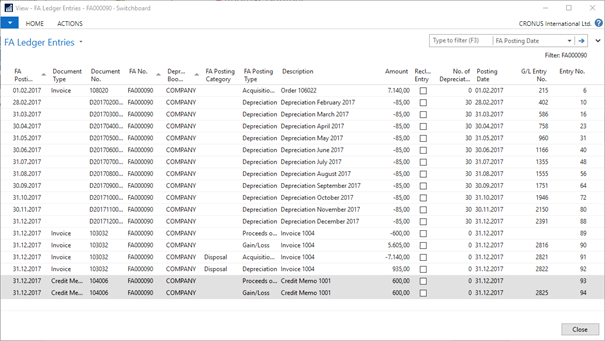

First: “Cancel Entries” for the credit memo (Entry No. 93 and 94)

Second: “Cancel Entries” for the invoice (Entry No. from 89 to 92)

Remark:

In case a disposal needs to be reversed it is necessary to put the focus on the entry with Type = “Proceeds on Disposal”.

Furthermore it is necessary to enable “Allow Correction of Disposal” in the Depreciation Book. In this example this was already necessary for posting the credit memo.

Following the remark we place the cursor on FA Ledger Entry 93 with Entry Type = “Proceeds on Disposal” and from the HOME tab of the Ribbon we click “Cancel Entries”.

In the following dialog we do not enter a check mark or a new Posting Date. We just click OK and get the following message:

“The ledger entries have been transferred to the journal.”

We then find a single line created in the FA G/L Journal.

As we cannot post a line without a balancing account we need to enter a new line as balancing line manually, with the same Document No. the same Posting Date and the same amount (just with the opposite decimal sign).

As Account No. we take any “transfer account”. After all our corrections the net change on this account should be zero.

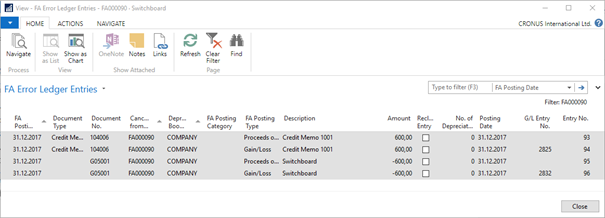

If we now post these two lines we will find FA Error Ledger Entries created.

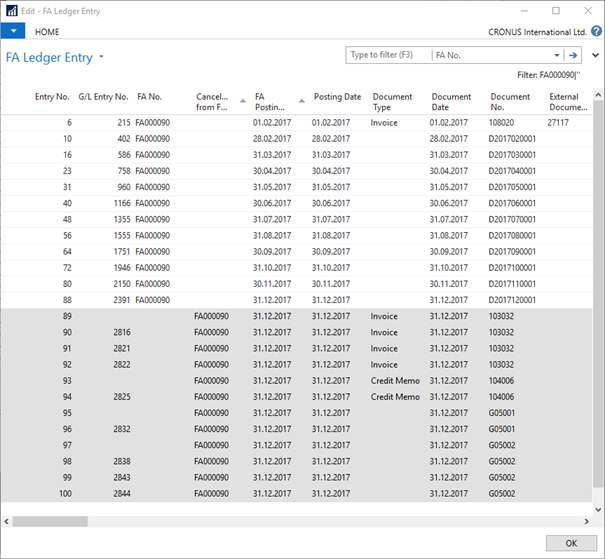

Entry No. 93 and 94 have been changed and Entry No. 95 and 96 have been created in the last task.

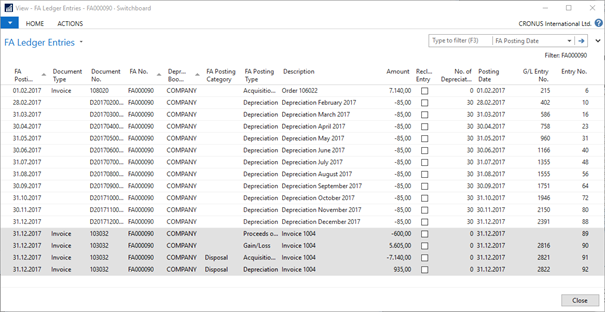

If we now check the FA Ledger Entries we see that Entry No. 93 and 94 are not visible on this PAG anymore.

Remaining FA Ledger Entries

Now we do the same again, this time with the cursor on Entry No. 89.

We get the journal line created and we enter the balancing line manually and post the journal lines.

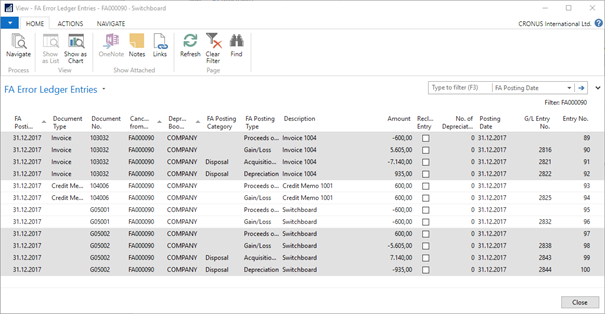

After that we find more FA Error Ledger Entries

And we see less FA Ledger Entries

If we check the FA Ledger Entry table (TAB 5601) we do find all the entries in this table, the “real” FA Ledger Entries with the Fa No. filled, and the FA Error Ledger Entries without the Fa. No. filled, but instead the “Canceled from FA No.” filled.

Imagine a situation in the previous example where the sales invoice has been created and then you realize that it was wrong. But this time you did not create the sales credit memo yet and look for a different way to reverse the wrong disposal.

Since “only” the invoice has been posted yet the G/L Entries, VAT Entries and Customer Ledger Entries are not balanced yet. And in addition there are wrong FA Ledger Entries.

The solution here is somehow similar but requires a special attention regards VAT and Customer Ledger Entries!

We would be in the situation as we saw in the previous example where we saw the “Remaining FA Ledger Entries”. And same as before we would place the cursor on FA Ledger Entry 89 with Entry Type = “Proceeds on Disposal” and from the HOME tab of the Ribbon we click “Cancel Entries”.

We get the journal line created.

But here we need to be aware that the amount is the amount without VAT and Posting Groups are not filled!!!

In order to get VAT corrected we need to manually calculate the VAT on top of the suggested amount (Procceds on Disposal) and we need to fill the Posting Groups so the VAT is registered properly.

Furthermore we still need to have the unbalanced Customer Ledger Entry in mind. In order to get his corrected we need to enter the Customer No. as Account No. in the balancing line manually.

If we now post the lines we get everything reversed.

After that we find more FA Error Ledger Entries.

The only thing we need to do in addition is to apply the two open Customer Ledger Entries manually.

Report

Report All responses (

All responses ( Answers (

Answers (