Hi

In Dynamics 365 Business Central, the tenant account LCY is MYR

A purchase invoice has been created in USD.

A payment has been sent to this vendor from the SGD bank account.

Let's say the PI amount is $1000 USD and the payment amount is 1441.20 SGD.

What is the best way to record this?

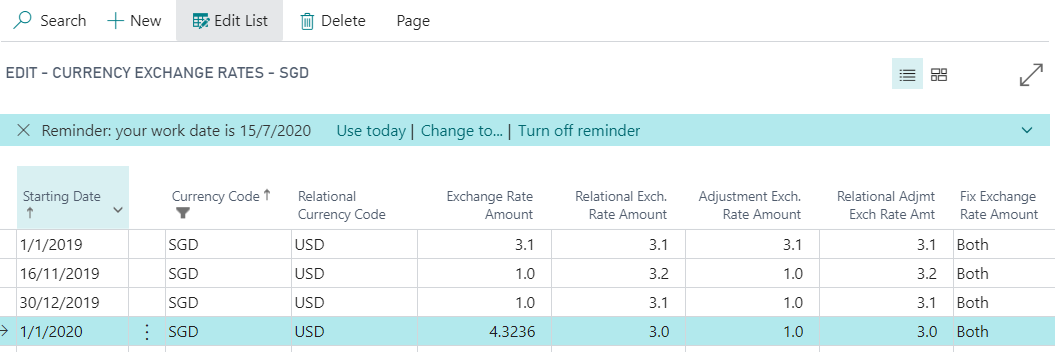

Exchange Table:

- In Currencies SGD, set Relational Currency Code to USD

- Exchange Rate Amount = (SGD amount x Relational Exch. Rate Amount) / USD Amount

- Fix Exchange Rate Amount set as Both

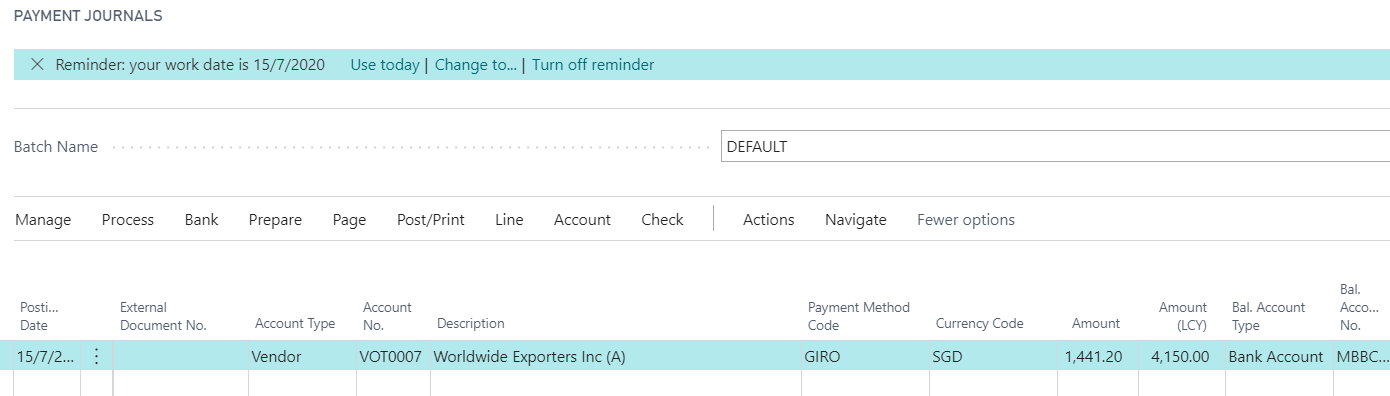

Payment Journal

- Choose Bank account in SGD

- Amount field indicate SGD amount

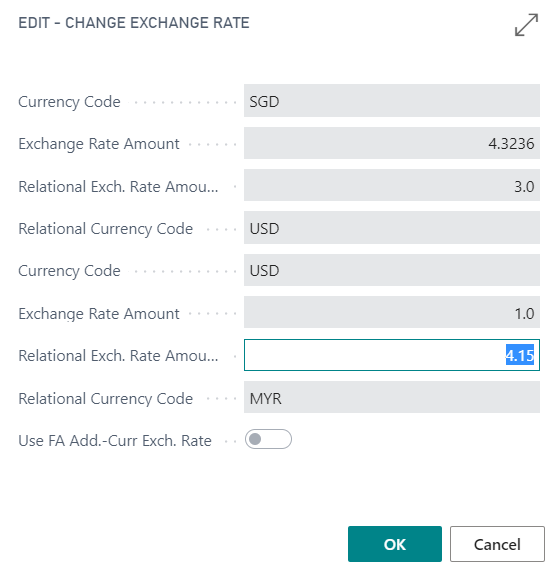

- Amount (LCY) = USD amount x rate

(1,441.20 / 3) x 4.3236 = 1,000.00

1,000.00 x 4.15 = LCY 4,150.00

If this way, we always need to reset the exchange table else system always count dual currency rate.

Any other best practice or correct way to do this would be much appreciated.