Hello,

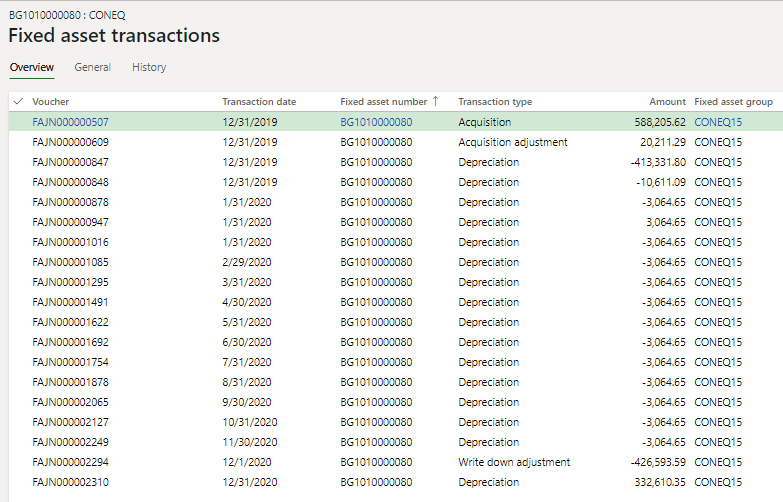

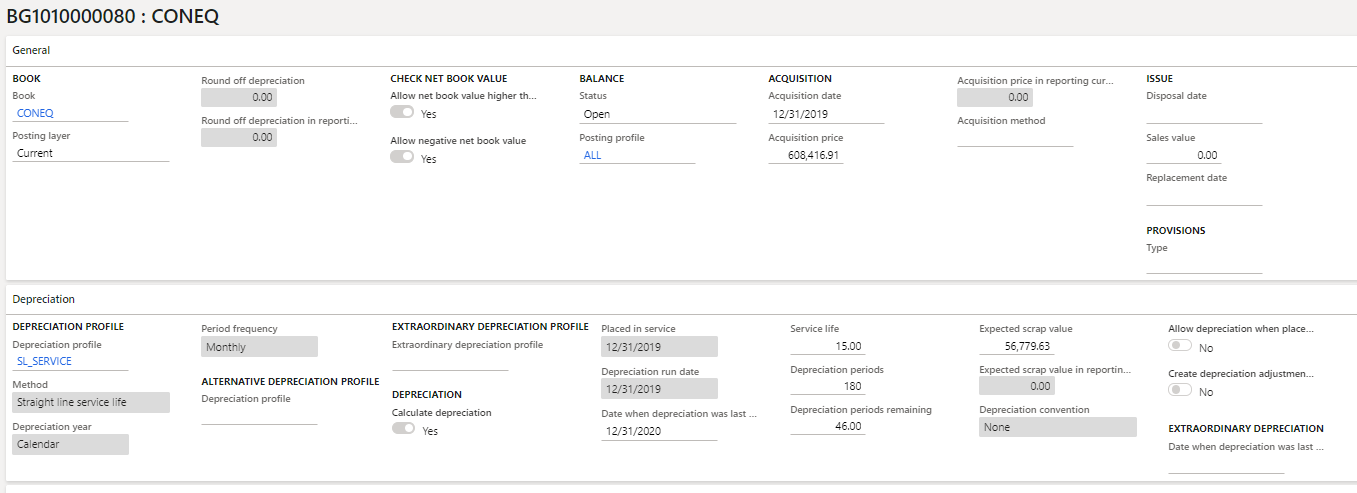

Our Company had impaired assets outside of the fixed asset module in our previous system and when we went live with D365 F&O, we decided to utilize the Write-Down function to book these impairments. I have the account setup and have tested the postings correctly, however after I posted the impairment to the asset and ran a depreciation proposal for the current month, it posted a material reversal of depreciation. How does the Write Down adjustment affect the depreciation calculation? And how can I recalculate the amount that was reversed?

We posted the Write Down adjustment on 12/1/20 in this example. Then a depreciation reversal was posted when we ran the depreciation for the month. Is there a way for me to recalculate and arrive at that number? I'm not sure how to vet the depreciation proposal calculation.