We face an issue with COGS calculation is not including the Landed Cost that we posted using Charge (Item) in Purchase Invoice.

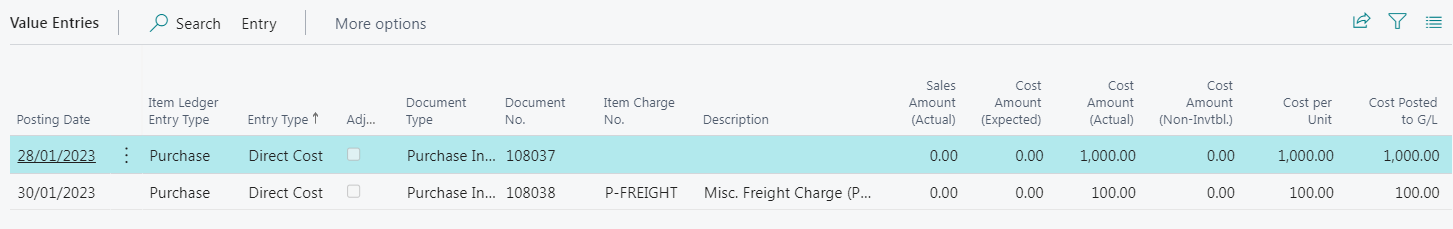

To illustrate my scenario, an inventory item was purchase for $1,000 via Purchase Invoice. There is landed cost of $100 apply, so we have recorded it as Charge Item in seperate purchase invoice. Below shows the Value Entries of the item mention. FYI, the item is "FIFO", and Automatic Cost Posting and Expected Cost Posting to G/L are both enabled.

When I sell this item in Sales Invoice for $2,100, I'm expecting the COGS to be $1,100 (Stock+Landed Cost) instead of $1,000 (Stock only). Is there some setting in BC that I miss out? Or my understanding regarding the entries is wrong?