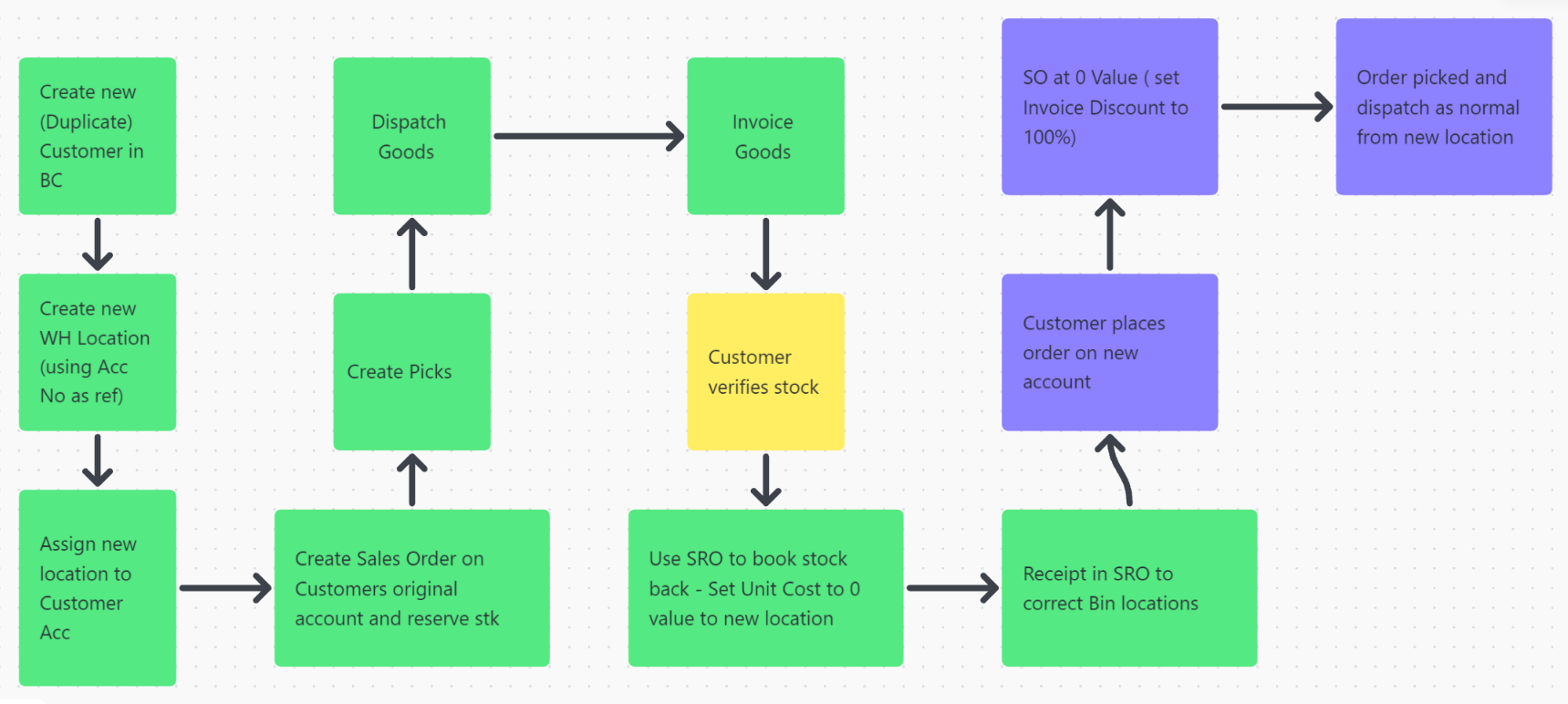

We're looking at managing a Vesting process in BC where we need to segregate and invoice goods upfront to a customer. They then call these goods off over a period of months. The process we have come up with is as follows:

1/ We're not sure how the LIFO costing process will affect this if we are booking stock in at 0 cost. Could the 0 costs end up being assigned to other stock, and a stock value applied to these items?

2/ We're not sure if a Sales Return Order or Item Journal is the best method to bring the stock back into the new location.

Any comments or suggestions would be appreciated.

Many thanks