Hello to everyone,

one of our customers has discovered issues with the sales price model of the project management and accounting model.

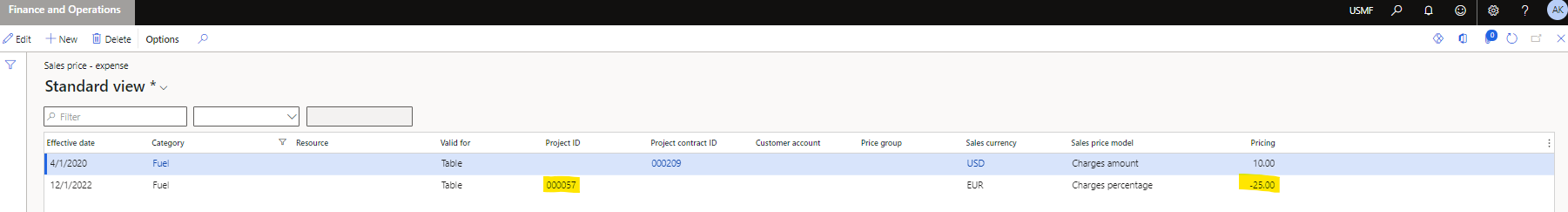

If I go to the Invoice journal of the accounts payable model and select account type "vendor" and offset account type "project" I can post the cost price and sales price. For example: In the Contoso environment I have set up the sales price (expense) with a charge percentage of -25.00%.

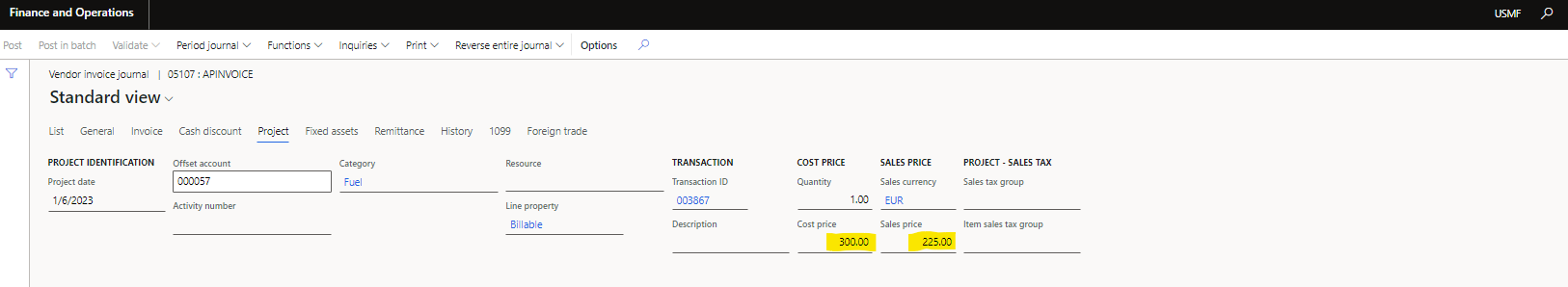

After that, I typed in in the invoice journal an invoice amount (=cost amount) of 300.00€. With the Formula [ (Cost price* (100+pricing) / 100) = sales price ] I got a sales price of 225.00€. This is right according to this side About sales price models | Microsoft Learn

But if I try the same approach in the environment of our customer, this approach won't work.

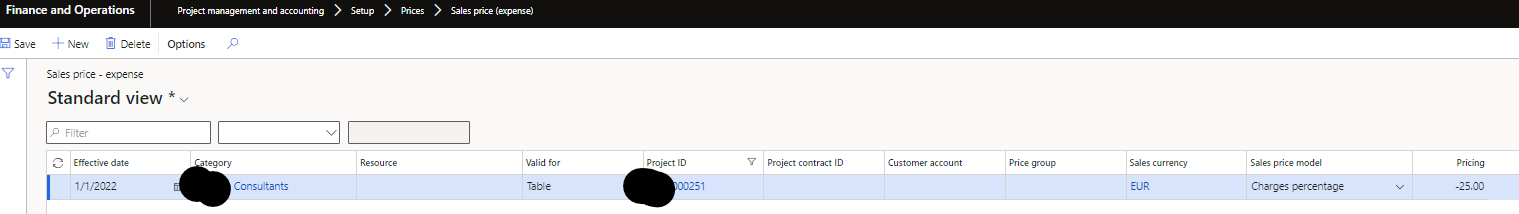

For example: I have a sales price (expense) with a charge percentage of -25.00% again.

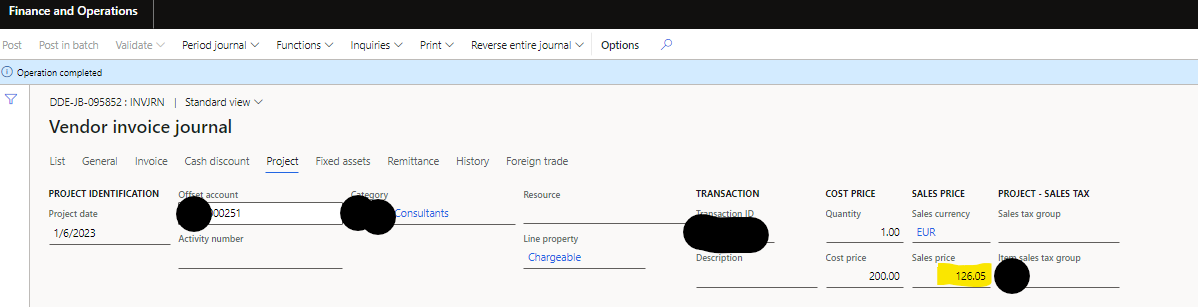

I post an invoice journal against the corresponding project ID. But the sales price depicted is not right. It states 126.05€ instead of the 150€. It should be 150€ according to the formula in the link above [ (200* (100 - 25.00) / 100) = sales price ]. For some reason it takes in the formula the "Net" cost price of 168.0672€. So 200€/1.19=168.0672€ -> [(168.0672€* (100-25) / 100]= 126.05€

Why is it taking the Net cost price in the formula and not the gross cost price? In the contoso environment it always takes the gross cost price in the formula.

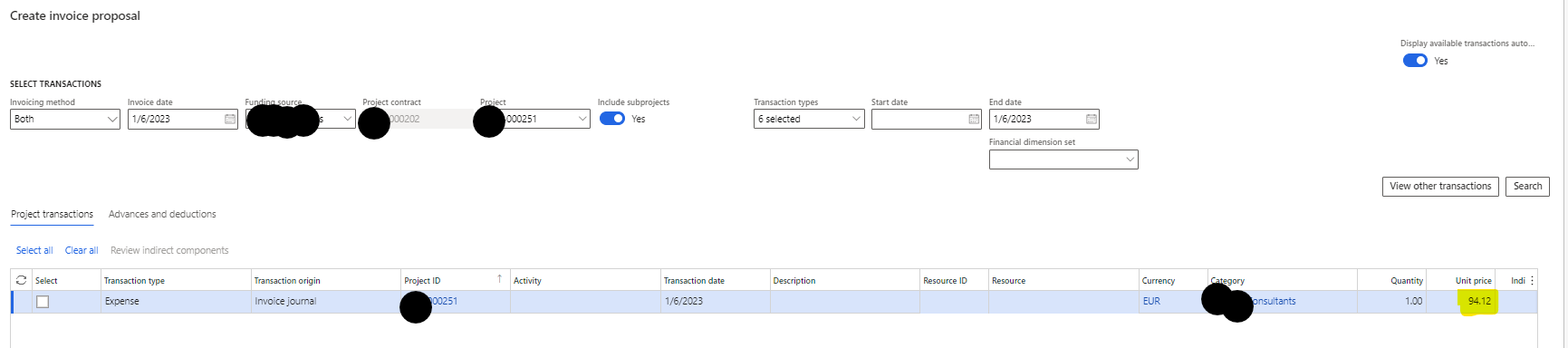

Another problem: After posting the invoice journal and trying to make an invoice proposal against the corresponding project ID, I get then the sales amount 94.12€, which is also strange because it deviates from the 126.05€ mentioned above.

Can someone help me with these two issues pleae?

Best regards

DNC