Afternoon All,

I am trying to dispose a fixed asset with the following set-up and process:

The Asset to be disposed

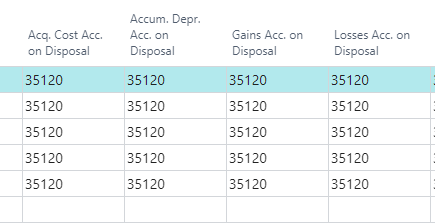

FA Posting Groups Set-up

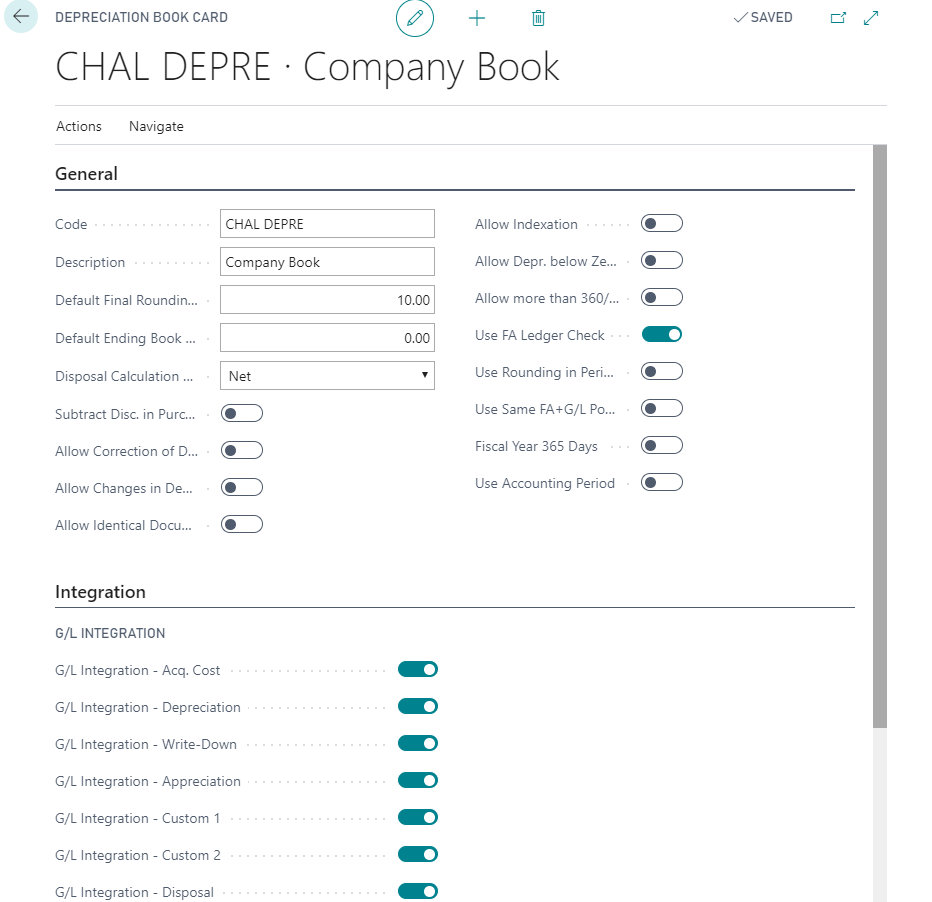

Depreciation Book

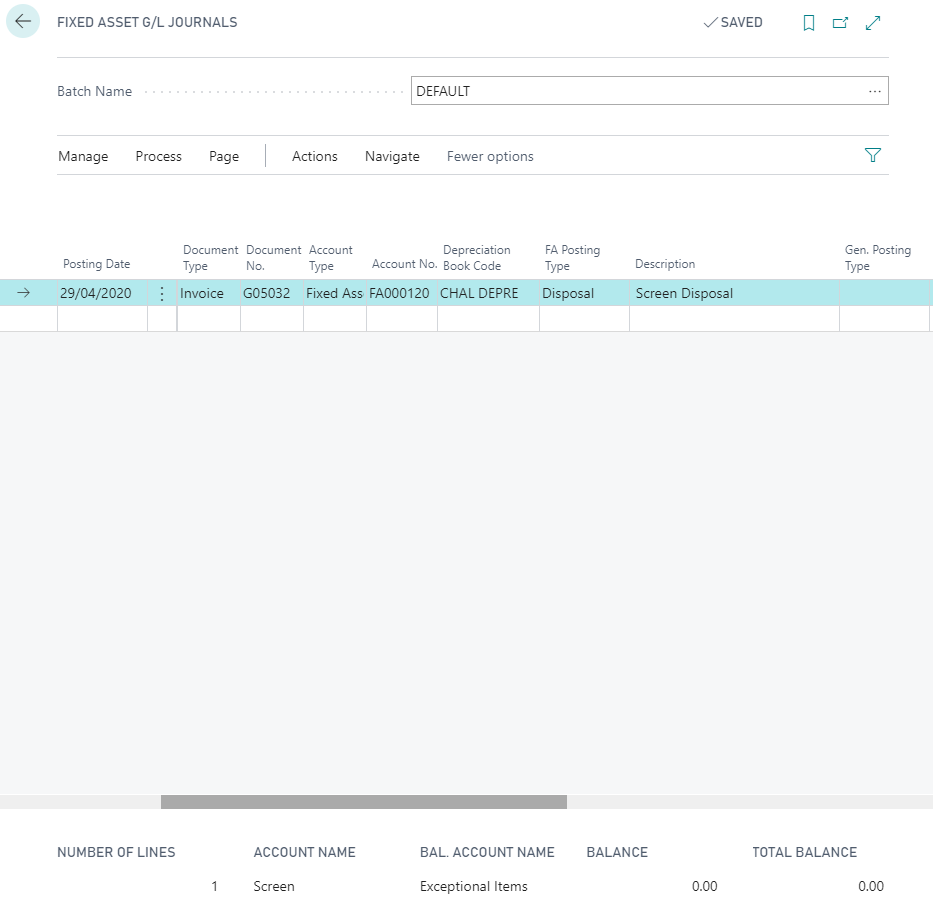

Fixed Asset G/L Journal

I have set-up the fixed asset G/L journal as per below, is this the out of the box way to dispose of a fixed asset?

Step 1

Step 2

No other fields have been set within the FA G/L journal. In this instance I have left the amount as '0.00'. I believe this will dispose the total cost of the asset (£12.53).

**Additional Question 1** - If I enter an amount (i.e. £10 to sell the asset) i receive the following error, is there a configuration setting on the depreciation book that is stopping this posting?

When I process and post the journal, I can see that the book value has been reduced to 0.00 (which is good).

**Additional Question 2** - My FA Posting Group Set-up has all disposal postings going to the same G/L account as per below (35120), is that best practice and a good way to set-up?

Upon checking the chart of accounts (35120 - where all disposal entries are posted - as per the FA postings set-up above) I see the following entries:

Is this correct and the out of the box way that BC should post the ledger entries?

The company accountant would like the breakdown of the posting in BC to be shown as per the below excel spreadsheet (apologies I am not an accountant and fairly new to BC). Will BC calculate the disposal within the same method as below, i.e. expected journal entries? Apologies the figures below aren't the same as mentioned in the rest of this post, its more the methodology behind the workings.

| Disposal of Fixed Asset - Expected Accounting Entries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BC G/L code |

|

41120 |

|

43120 |

|

|

|

|

|

|

|

|

| Asset Number |

|

Cost |

|

Depn at 31/3 |

|

NBV at 31/3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FA000120 |

|

|

250 |

|

200 |

|

50 |

DR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sale Price |

|

|

|

|

|

100 |

CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit on disposal |

|

|

|

|

|

50 |

CR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting Entries (35120 Account) |

|

|

|

|

|

Other side |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sale Proceeds |

|

|

|

|

CR |

100 |

|

Bank (or Sales Ledger Account until paid) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reverse Cost |

|

|

|

|

DR |

-250 |

|

Fixed Asset Cost |

41120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reverse Depreciation |

|

|

|

CR |

200 |

|

Depn |

|

43120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance c/f in 35120 |

|

|

|

|

CR |

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting Entries (41120 Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Original Cost |

|

|

|

|

DR |

250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reverse Cost |

|

|

|

|

CR |

-250 |

|

35120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance c/f in 41120 |

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting Entries (43120 Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation at 31/3/2020 |

|

|

|

CR |

200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reverse Depreciation |

|

|

|

DR |

-200 |

|

35120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance c/f in 43120 |

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting Entries (Bank Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sale Proceeds |

|

|

|

|

DR |

100 |

|

35120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Any help is very much appreciated, once we have this over the line, I can move on to setting up customer sales ledgers :-)

Regards,

Matt Smith