Hi,

I want to use the 'tax included with item price' option in the tax detail definition.

I have a customer with a tax schedule id (TAX_INCLUDED) based on 2 tax details (TPSINCL, TVQINCL).

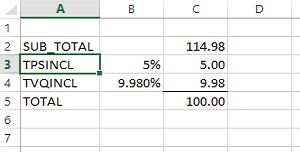

See Image 1. Excel Calculation = Good amounts

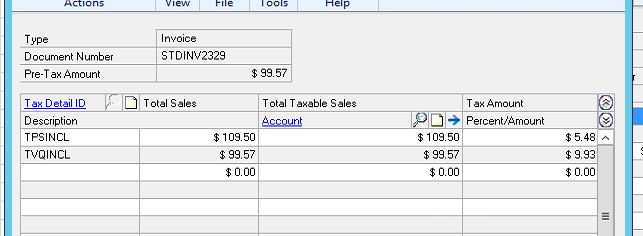

See Image 2. GP Calculation = Wrong amounts

How can I resolve this ?

Image 1.

Image 2.

*This post is locked for comments

I have the same question (0)